Now I have to admit up front that when I got the press release for this new website I forwarded it on up to HQ because I’m related by marriage to the PR folks for the company. But in the time since I got that release a few weeks ago, I’ve received more than one email from other sources in the business telling me I need to write about this.

Date Archives April 2008

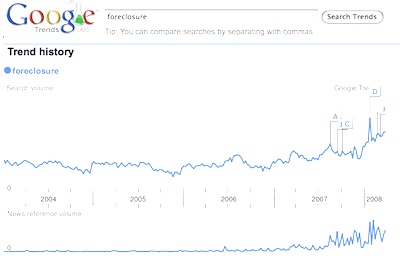

Question from a reader regarding Charlottesville area foreclosures

Our agent didn’t show much interest in this kind of properties and I didn’t ask him if it is because there are not many on the market currently or he is just not strong in that area.” … And, foreclosures are quite the hot topic.  If you’re looking for the most accurate, up-to-date information on foreclosures in the Charlottesville area, I personally use the HooK’s site ; I’ll bet they would get good traffic if they devoted a page to foreclosures and the link stayed the same every week – thehook.com/foreclosures … just an (selfish) idea.

If you’re looking for the most accurate, up-to-date information on foreclosures in the Charlottesville area, I personally use the HooK’s site ; I’ll bet they would get good traffic if they devoted a page to foreclosures and the link stayed the same every week – thehook.com/foreclosures … just an (selfish) idea.

Upgraded to WordPress 2.5 tonight

Please let me know if anything isn’t working . One change is that I disabled the No Self Pings plugin ; we’ll see how that goes.

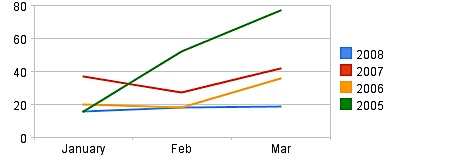

“Official” Real estate Market report for Charlottesville area

This is my market report for the City of Waynesboro and Augusta County and this is the market report I wrote last Monday focused on the Central Virginia real estate market ; my market report is more focused on the Charlottesville market area – Charlottesville/Albemarle, Fluvanna, Greene and Nelson Counties – while the CAAR report encompasses the entire super-region. … For a graphical representation, check this out – for the first quarter 2008, sales of condos are down – way down – relative to the past few years.  I’ll update this post on Monday when the Daily Progress releases their interpretation/report.

I’ll update this post on Monday when the Daily Progress releases their interpretation/report.

Online buyers’ habits changing

The article does cover quite a bit of ground, from Realtor.com to Roost to FranklyMLS (review coming soon), to Trulia . Thanks to Brian for bringing it to my attention, and to Frank for pointing her my way If only Renae had put a link to my blog …

Be careful picking your lender

You may be approved for the program today, but by the time you end up buying, the program may have been eliminated. If this happens to you, you’ll have to either come up with more money for a down payment or switch to another lender in order to not be in default come settlement day.