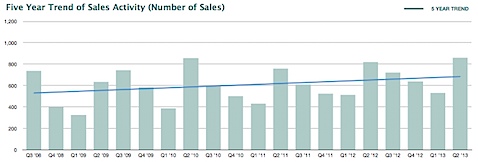

When looking at the real estate market (or any market, really) We’re always looking backward, thinking about today and trying to project tomorrow, next year and five years from now.

We’ll be posting tomorrow our 2nd Quarter Market Report for the Charlottesville area, and we’re making final edits and number crunching today.

I’m inclined to echo Bill McBride at Calculated Risk –

The “wide bottom” was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.”

I think we’re in for at least 18 – 36 months of flatness, once the optimism of early 2013 fades and interest rates increase. Nota bene – The data below may or may not apply to you if you’re currently contemplating buying or selling. This is aggregate data – meaning if you’re looking for a single family home in Ivy with 4 bedrooms and 2.5 baths, the data and brief analysis below also includes affordable new construction in the City of Charlottesville, a $1.2 million home in Ashcroft in the County and everything in between. In other words, if you have specific questions, ask me. I’m a real estate agent .

That said, a few tidbits to whet your appetite for data for Charlottesville and Albemarle (Greene, Nelson, Louisa, Fluvanna coming tomorrow) –

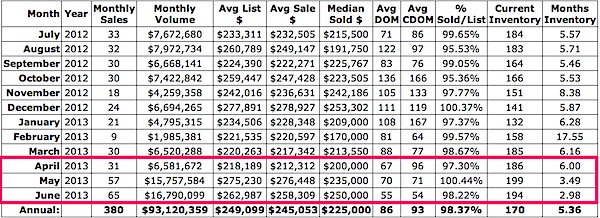

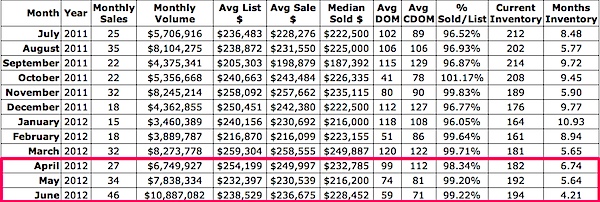

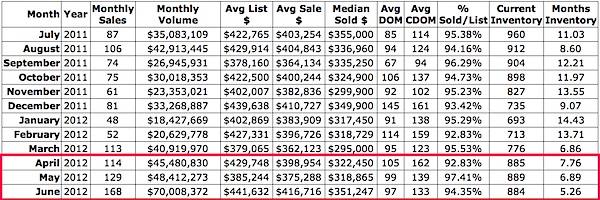

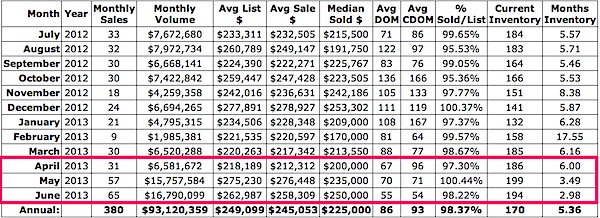

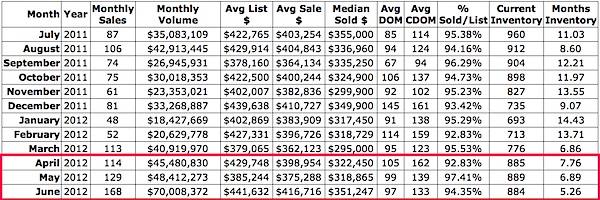

Attached homes in Albemarle and Charlottesville* –

153 attached homes sold in Charlottesville and Albemarle in April, May, June of 2013 versus 107 in that same time frame of 2012 – a 70% increase in volume. A full third – 52 – of the attached homes sold were marked as “new.” (interestingly, only 4 attached homes sold in the Charlottesville MSA in that period).

If you’re looking at new attached homes, be prepared for little negotiation on price. If you’re looking at existing attached homes, be aware that you’re likely going to have more (and sometimes better) options as far as price and yard size.

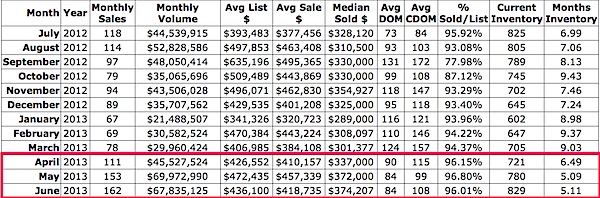

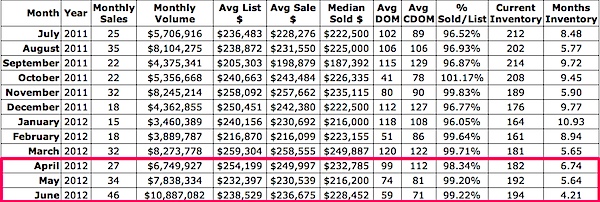

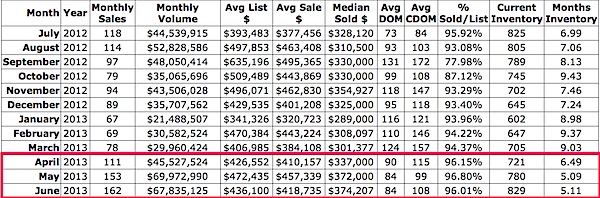

Single family homes sales in Charlottesville and Albemarle

427 single family homes sold in the 2nd Quarter of 2013 in Albemarle and Charlottesville; 411 sold in the 2nd Quarter of 2012. I’d have been happy with flat sales, but a slight uptick is a good sign. In contrast with the attached home new construction numbers above, only 10% – 46- of closed sales in the 2nd Quarter of 2013 were marked as new construction. From my perspective, single family new home sales felt like they were more, but maybe that’s just because I’m around so much new construction all the time. (and this is a major reason I look at and embrace data over emotion and perception)

What impact will rising interest rates have on buyers?

1 – It will push some to act faster.

2 – It will cause some to not buy.

Looked at another way:

Buyers’ Purchasing Power

Let’s look at an example: A young couple is looking for a home and have predetermined that their budget will only allow them to spend $1,000 a month on a mortgage. At today’s mortgage rate of 4.5%, they could afford a $200,000 mortgage ($1,013 principal & interest). However, if rates jump to 5%, they would have to lower their mortgage amount to $190,000 in order to keep their monthly payment where they need it ($1,020). At 5.5%, the mortgage would need to be no more than $180,000 ($1,022).

The Impact on Prices

This decrease in buyers’ purchasing power will have an impact on home values going forward. We do not believe it will cause a decrease in prices. However, we do believe it will likely cause current rates of appreciation to slow.

Read More