This is from my monthly note … I don’t often post here what I write there, but am making an exception.

We’re at the halfway point. I think the market can be summed up thusly: Buyers are buying, sellers are selling, but there is, and has been, an underlying mistrust of the market by both buyers and sellers. A lot of buyers were burned or saw their friends or parents burned in the previous market and are reluctant to take the plunge to buy. A lot of sellers remain underwater – even those who bought five to ten years ago – and are either reluctant or unable to sell. About a third of sellers nationwide are still in negative equity positions. (I don’t have access to local data). Short advice: If you need to sell and can, do. If you want to buy and have the life circumstances to do so, consider buying.

On to the data, solely for Charlottesville City and Albemarle County, respectively:*

Sold in 1st Half 2013: 246 + 695 = 941

Sold in 1st Half of 2014: 259 + 683 = 942

Flat market, right?

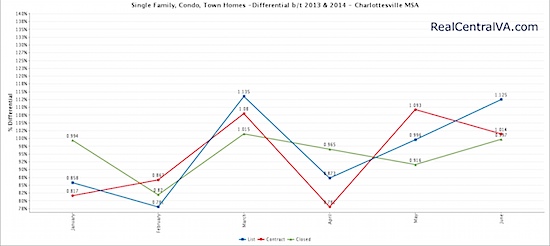

Looking broadly at the data, one can reasonably and simply conclude that when prices go up, sales go down and when prices go down, sales go up. In the City of Charlottesville for single family homes, 19 more homes have sold so far this year than last year’s first half, but June’s median price is down about $5K. The County’s market is equally odd; 26 fewer homes have sold in the first six months than last, but June’s median price is up by about $28K. Huh?

Micro markets matter.

Broad trends – even at the locality level – can be misleading. I’ve been advising clients (and writing and writing) that national data, while good for headlines, matters little when making buying or selling decisions in the Charlottesville area. If you’re looking to make a decision, analyze your micro market.

For example, the $475K – $600K single family detached market in the Brownsville and Crozet Elementary districts: There are 64 such homes under contract in Albemarle County; 38 (59%) are new construction. In Crozet, there are 22 homes in that price range under contract; 18 (82%!) are new construction. If you’re trying to sell a home in Crozet in that price point, your primary competition is new construction and you need to prepare and price with this in mind. In contrast, in Baker Butler and Hollymead Elementary school districts (29 North region), there are 46 single family homes under contract and four in the $475K – $600K range and all are resales. Micro markets are far more relevant than county-state-national market data (or zestimates).

Broadly, we might be witnessing a balancing of the market. I’ll let you know next year what today’s market is doing.

(All of my PDFs are here, if you’re curious and/or you want to fact-check me. Please do; I’d appreciate constructive criticism.)

The inventory question:

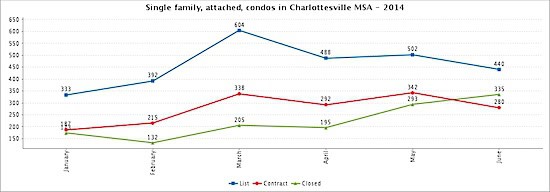

In the Charlottesville MSA (Charlottesville, Albemarle, Fluvanna, Greene, Louisa, Nelson), 2,759 homes have been listed so far this year versus 2,876 last year, which is a small enough difference – about 5% – that I’m going to call the new listing numbers mostly flat.

Have questions about the market? Curious what your home might be worth? Thinking about buying? Call or email me anytime – 434-242-7140.

Update 12 July 2014: We at Nest Realty have released our First Half 2014 market report. Download it here; it’s a brand new format – I/we hope you like it!

Update 14 July 2014: I wrote a brief market report specifically for Crozet, Virginia; it’s a highlight that micro markets matter.

* All data from the Charlottesville Area Association of Realtors’ MLS … data is as accurate as can be on the day I pulled it.

Pingback: 2014 Mid-Year Crozet Real Estate Market Update - Some Numbers - RealCrozetVA — RealCrozetVA