“Normal” is “now”.

– Human settlement patterns (where people are living and working)

– Gas prices

– Expectation of permanence/transience

– Interest rates

– Property tax rates

– Monetary supply

– The internet’s availability and impact

Those are just a few of the ways that 1999 differs from 2011, and makes application of “normal” challenging.

Here’s something that hasn’t changed – people need homes. Buying a house is a choice, and one that comes with greater responsibility than renting – you’re accepting on the maintenance, the permanence, the mortgage, the community, the risk. If you’re not ready for those, don’t buy a house. If you’re ready to buy a home, do your due diligence and consider it.

“New normal” is a shifting term, applicable to virtually every evolving industry.

Heck, I’ve been seeking “new normal” for years.

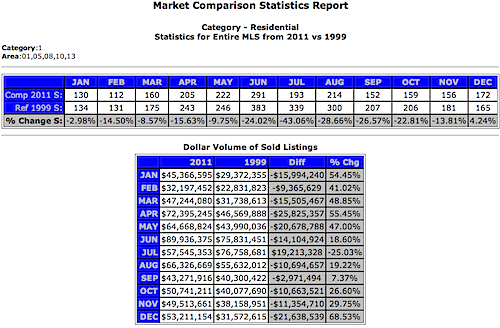

But I thought I’d look at the data and briefly compare the 1999 Charlottesville area real estate market with the 2011 one … keeping in mind that so many things are different, thus negating in a lot of ways the comparisons.