” I live in the city, but the time is maybe, possibly near for a move to a more residential location. When I think about moving, I worry about finding the amazing neighbors I have here and I have to admit that reading your blog has me thinking the community feeling I have in my little neighborhood can be found elsewhere. I’ve been following your story from the start and will continue to do so. … ” I’m curious how many other neighborhood blogs there are in the Charlottesville/Albemarle area.

Posts Published by Jim Duncan

Homebuyer Tax Credit in 2010 – Who’s Eligible?

• Current home owners purchasing a home between November 7, 2009 and April 30, 2010, who have used the home being sold or vacated as a principal residence for five consecutive years within the last eight.

…If you or your client purchased a home between January 1, 2009 and November 6, 2009, please see: 2009 First-Time Home Buyer Tax Credit . … Under the Extended Home Buyer Tax Credit, which is effective on November 7, 2009, single buyers with incomes up to $125,000 and married couples with incomes up to $225,000—may receive the maximum tax credit. … If you or your client purchased a home between January 1, 2009 and November 6, 2009, please see 2009 First-Time Home Buyer Tax Credit . — Part 1- Quick Update on the Charlottesville Real Estate Market Part 2 – Short sales and Foreclosures in Charlottesville Part 3 – Homebuyer tax credit in 2010 – Who’s Eligible?

Short Sales and Foreclosures in Charlottesville

As of this writing, short sales and foreclosures are not yet considered “the market” when appraisers are doing their analyses, but I as a Realtor representing buyers and sellers am absolutely considering short sales and foreclosures when advising my clients. … When advising sellers who may be considering short sales, we will have a long and in-depth conversation (or two or three) about the considerations, ramifications and things that they and I need to do in order to effectively conclude a short sale transaction.

… • Death –of a borrower • Dying-Sickness of a borrower affecting their ability to earn and pay their debt • Destitute-an involuntary loss of income Divorce- in this case, when one of the occupants leave and it affects the income of the house it can be deemed an acceptable hardship.

… Foreclosures in Charlottesville: Two properties with $100k price reductions A quick look at some of the foreclosures in the Charlottesville/Albemarle area shows that there are foreclosures ranging from $25,913 to $1,010,000. (more trustee sales notices get posted every day) These are some of the foreclosures in Charlottesville and Albemarle that are listed in the Charlottesville MLS: — Part 1- Quick Update on the Charlottesville Real Estate Market Part 2 – Short sales and Foreclosures in Charlottesville Part 3 – Homebuyer tax credit in 2010 – Who’s Eligible?

Two Bloodhound Posts that Struck Me

Jeff Brown describes how I try to represent my clients …. when I asked a client this year whether hiring me was worth it ? (because that’s all that matters to the client – whether buyer or seller) My client’s response was perfect. He said, “Everything went so smoothly that I didn’t have a chance to really evaluate your negotiation or problem-solving skills.” … I don’t have a Rondo; I have a Honda Pilot – it’s practical, is four-wheel drive for showing land (and getting out in the snow), and has third-row seats for the family.

Transcript of Radio show – 27 December 2009

Moore : And as our initial caller seemed to be asking is: there seems to be or you would expect a much greater – the term punishment comes to mind although that’s not really what I’m trying to say – but a strategic default makes it sound like it’s all about how much money you have left in your pocket at the time rather than – where’s the punishment that goes with it for not paying it off. … When you make your money when you sell is when you buy, so you need to make sure you buy smart from day one and I do that by giving them as much data and analysis as possible so that they can come to these conclusions on their own and the second part of that is that I’ve prepped them that if they buy a house for $100,000 today that I expect it’s going to be worth a little bit less next year. … I think that there’s going to be more distressed properties coming on the market now in the Charlottesville and Albemarle area and I’m seeing that as far as the daily updates that I get as far as the number of notice of trustee sales in our market and I’m seeing more of the MLS’s coming on as foreclosures and I’m seeing more anecdotally, again there are two properties, one in Louisa and one in Albemarle last week that each had $100,000 price reductions. … What I’m hoping to see in the next couple of years is in addition to having homes and coffee shops, etc. is homes and places to work so that people won’t have to get into their cars to drive to work and I think that’s the very good thing from the perceptive of going back to the sociological change being close to your neighbors and being close to business as keeping everything local is another trend that we’re seeing develop over the past couple of years to 2010 and beyond.

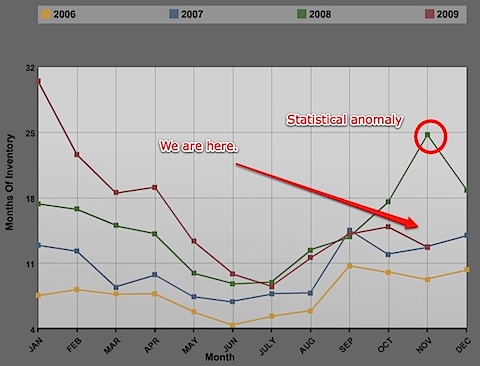

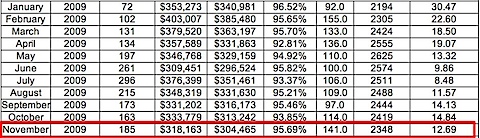

Quick Charlottesville real estate market update – End of 2009

Just for residential real estate in the City of Charlottesville and the County of Albemarle –  Predictions and Prognostications: The “bottom” of the Charlottesville real estate housing market may come in the third or fourth quarter of 2010. … I have no idea, and if I told you, I’d be lying. 2010 is likely to bring more moderated prices, with increased transactional volume. 2010 will see higher interest rates, that will still be remarkably low. … Please let me know if you would like to see any specific information or data) More on Home Sales – Charlottesville/Albemarle

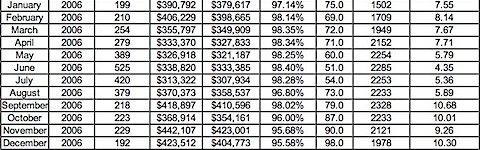

Predictions and Prognostications: The “bottom” of the Charlottesville real estate housing market may come in the third or fourth quarter of 2010. … I have no idea, and if I told you, I’d be lying. 2010 is likely to bring more moderated prices, with increased transactional volume. 2010 will see higher interest rates, that will still be remarkably low. … Please let me know if you would like to see any specific information or data) More on Home Sales – Charlottesville/Albemarle ![]() 2006

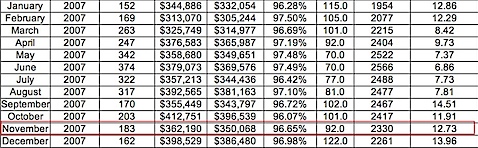

2006  2007

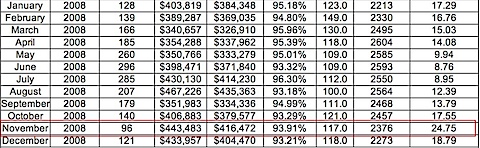

2007  2008

2008  2009

2009  More on Home Sales – nationally New-Home Sales Drop 11.3% As Impact of Stimulus Fades Home Sales up as Buyers Respond to Tax Credit – National Association of Realtors (read with the biased grain of salt) Why U.S.

More on Home Sales – nationally New-Home Sales Drop 11.3% As Impact of Stimulus Fades Home Sales up as Buyers Respond to Tax Credit – National Association of Realtors (read with the biased grain of salt) Why U.S.

…For the new-home sales, the decisions were made in November, when there was no such scramble to qualify for the tax credit.

The Government Has Unlimited Funds

From the Wall Street Journal : The Obama administration’s decision to cover an unlimited amount of losses at the mortgage-finance giants Fannie Mae and Freddie Mac over the next three years stirred controversy over the holiday. … Unlimited access to bailout funds through 2012 was “necessary for preserving the continued strength and stability of the mortgage market,” the Treasury said. … And at UrbanDigs : By the way, did you notice the quiet move the US Treasury made to prop up the GSEs a few days ago – in essence, ” removing the caps that limited the amount of available capital to the companies to $200 billion each “. … Unlimited access to bailout funds through 2012 was “necessary for preserving the continued strength and stability of the mortgage market,” the Treasury said.