6 Kiowa Lane, Lake Monticello . ( bolding mine – asking price is $132,000 – purchased for $203k in April 2007 ) Bank foreclosure- assessed for 217,600 -an excellent buy! call for addenda-Bank of America Prequalification required on all offers. Free appraisal and credit report if buyer finances through Bank of America Home Loans. Great Lake Monticello community-lake and golf community-home is located outside of the main gates.

Posts Published by Jim Duncan

Amtrak Line More Trafficked than Expected

The new Amtrak train between Lynchburg and Washington had twice as many passengers as expected during its first month of operation in October … … More than 8,500 people got on or off the two trains in Charlottesville during October. That was about 2,300 more riders than the city had in the same month of 2008. Is anyone using this line to commute from Charlottesville to DC?

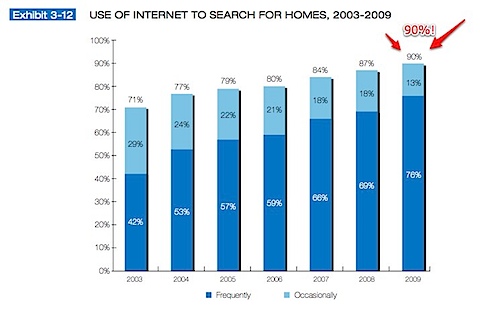

Searching for or Selling Homes – the Internet Matters

From the National Association of Realtors’ 2009 Profile of Home Buyers and Sellers: Q: Why use print ? A: Because . (there’s really no better answer other than “to show sellers that we’re doing something to market their homes, even if the data say that it’s neither effective nor a good use of money)  Q : But … is print advertising useful to buyers?

Q : But … is print advertising useful to buyers?

…A: They drive by. ( signs matter ) ( here are some steps to search for a home in Charlottesville )

… Q : Does a (Charlottesville area) Realtor’s knowledge of the local area matter to buyers?

Zillow Steps Beyond Free – Rental and Search

2 – When searching for homes for sale, you will be able to search by monthly payment – homes for sale and for rent. 3 – The spammy craigslist will see some real competition 4 – Eventually (I’d wager) Zillow is going to charge for everything they can. … Real estate blog roundup: Zillow starts charging for listings – 1000WattJoel Zillow adds Rental Listings – Charges for them – Tribus Zillow Adds Lease Search, Fills in a Critical Gap in the Their Offering – AG Zillow to Go Head to Head With Realtor.com, RPR & Your Wallet? – AgentGenius Announcing: Rental Listings and Search – ZillowBlog Zillow Adds Rentals – RCG My notes from the phone call yesterday are below. … In the Charlottesville Current market – a lot of homes are for sale or rent.

Prepping to Buy a House in Charlottesville

Now is the time when people really start to talk about these things in earnest, so here is the thing: if you’re thinking about buying a house, it’s a great time to buy! … But if you’re thinking about buying in the Spring: – now is the time to start researching. – Drive through neighborhoods, see how they’re decorated if that interests you or if it disinterests you. It’s good to know what you might be getting yourself into. – Start scouting things out, ask questions, search for homes and find a realtor (I am one) and start looking for vacant houses so you have a feel for what you’re going to see come Spring when houses come on the market. – Prices now are starting to moderate even more. … Start interviewing buyers agents , ask questions, because when you’re talking about interviewing buyers agents , you’re really talking about spending a lot of time with somebody who is hopefully going to be someone you like, trust, and is a professional who is experienced.

Changes coming to FHA loans

“We want to ensure that we are able to continue to support the housing market in the short term and provide access to homeownership over the long-term, while minimizing the risk to the American taxpayer,” Housing and Urban Development Secretary Shaun Donovan told a congressional committee in written testimony.

…The FHA charges an upfront insurance premium of 1.75% of the total cost of the mortgage which most borrowers can roll into their loan, and then they pay additional annual premiums of either 0.5% or 0.55%, depending on their down payment. … The FHA says that it will limit the amount of money that sellers can provide for closing costs on home sales to 3% of the home price, from the current level of 6%.

…One close observer of the mortgage channel, who we hope to interview soon in The IRA, says that given the recent deterioration of mortgage credit, it is impossible that BAC has not gotten its pari passu portion of the losses which are hitting the FHA.

Twitter Week in Review

0930 appointment to show houses in Charlottesville means this doesn't quite feel like Sunday morning # RT @Scobleizer: Tremendous rant by Fake Steve Jobs on the ATT's whining and what's wrong with the USA http://bit.ly/8UGBlX…