always looking for hindsight. Today.

In January two of the six things I noted to watch were:

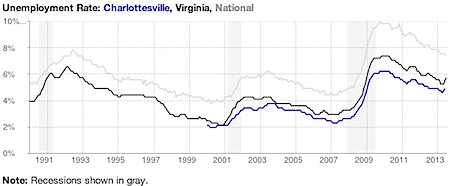

More confidence in the market as unemployment stabilizes (underemployment is a different conversation). More stability is likely to mean more buyers

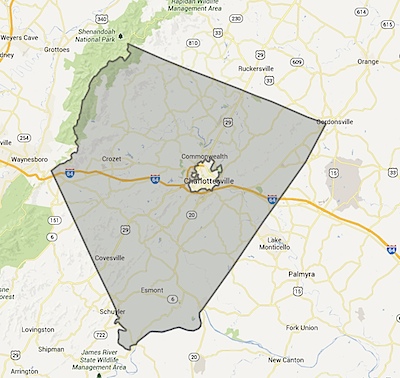

Frustration felt by buyers who are seeing prices rise (again). If prices do indeed start to rise again, many buyers will be kicking themselves for waiting. Some are predicting national home prices to rise by nearly 10% this year; if this happens (and I hope it doesn’t), expect to see more discussion about another bubble. But … if you’re confident you’re going to be in the Charlottesville area for the next 5-7 years, it might be worthwhile to have a conversation about buying a home.

Last week I looked back at Apartments.

Confidence. Buyer (and seller) confidence, consumer confidence, builder and real estate agent confidence … and frustration felt by buyers as the market turns.

Now that it’s August, I can say with confidence – We’re in an odd time right now. There is a great deal of (over) confidence and a seemingly balanced level of trepidation in the market. The Charlottesville real estate market recovered with a storm in early 2013 – the pace was rapid, bidding wars were common and sellers were justifiably optimistic. Things seem to have tempered a bit now.

Takeaways from this post:

– Builders are building a lot right now. Very few are building communities in addition to houses.

– Single family homes sales are up July to July – Albemarle is up 23%, Charlottesville is up 5% (really – 2 units), and other counties are mostly flat (click through to see the charts at the bottom).

– Interest rates are up – from the mid 3’s in early 2013 to mid-4’s now. (click through to see the 30 year chart for some perspective). Historically, interest rates are crazy low, but the jump from unreasonably low to more moderate has absolutely affected buyers’ buying ability, sellers’ ability to sell and confidence on both sides.

– If you’re considering buying or selling right now or in the next 6 months, ask questions (you could start by asking me) – there are a lot of moving parts in today’s market and every life situation is different. There is no one answer “buy now!” “sell now!”

– Confidence is an individual concern; market sentiment is one thing, but “will I be employed next year?” is something only you can answer. But … the Charlottesville MSA Unemployment Rate remains relatively low. The underemployment rate? Different conversation.

Cost of Buying a Home Affects Confidence & Purchasing Decisions

Think about this; as interest rates go up, so does the cost to buy (and own) a home, only for Principal and Interest (not including Taxes and Insurance):

– Loan amount of $300k. Interest rate of 3.5% = monthly payment of $1,347.13

– Loan amount of $300k. Interest rate of 4.5% = monthly payment of $1,520.06

A difference of $172.93 – That’s real money. Grocery money, gas money, vacation money.

On the confidence matter, the NAR succinctly states:

A confluence of factors tempered REALTOR® optimism: higher mortgage rates, rapid price gains amid a slow economic recovery, lack of inventory in many areas, and stringent credit conditions.

Well said.

Buyers are frustrated –

– Interest rates are rising

– Many are able to sell their existing homes, but those who want to buy (and have wanted to buy for a while) are finding that Quality Inventory remains low. (I’ll touch on inventory in my next post). Buyers aren’t buying property because they want to buy a property, they’re looking to buy homes.

– Sellers – if you want to sell, price right and make your home as close to perfect as possible.

Read More