Choosing where you live is a huge, immensely significant decision. As I jokingly tell my buyer clients – “it’s no big deal … you’re just deciding where you’re going to live for the next five to ten years … “

Last year I asked you what were the most important factors when evaluating where you want to live. I’m finally getting around to publishing the results. (and thank you to all who answered – for answering and for your patience).

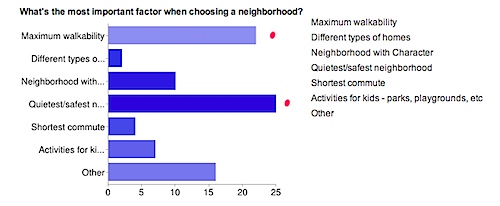

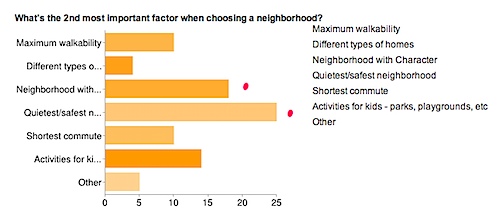

While by no means a scientific survey, as the RealCentralVA readership is probably skewed (I’d argue towards the more informed) 86 responses isn’t insignificant.

Not surprisingly, the top two answers to “What’s the most important factor when choosing a neighborhood?” are “Maximum walkability” and “Quietest/safest.” “Other” came in a reasonable third place.

What’s the 2nd most important factor when choosing a neighborhood? Revealed an interesting shift – “safety” and “neighborhood with character” came in 1st and 2nd with “activities for kids” edging out walkability and length of commute. Sadly, there are few “neighborhoods with character” being built in Charlottesville, so new construction buyers are left choosing from either soulless “neighborhoods” or older housing stock that likely needs some degree of renovation and updating, but may have the “proximity to stuff” that matters.

From my perspective, everything is about location (naturally) – but “quality location” can be a relative term.