Download the Nest Report here, dig in, ask questions, and remember – this is a snapshot of the total market. Your market will vary, whether that’s a condo in the heart of downtown Charlottesville or the outskirts…

Browsing Category Fluvanna

Charlottesville Area Association of Realtors’ 2015 Market Report

Dig in. Ask questions.

Short takeaways when looking at the Charlottesville area market report:

Three Charts Depicting the Charlottesville Real Estate Market Entering December 2013

Curiosity stole an hour of my morning … I intended to update only the Crozet “When do homes come on the market†spreadsheet, got lost there for a bit and decided to look at the Charlottesville MSA numbers.

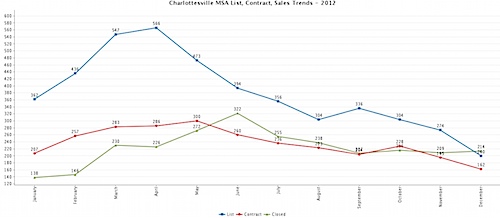

2012’s Charlottesville MSA sales trends – looking at when homes came on the market, when they went under contract and when they closed.

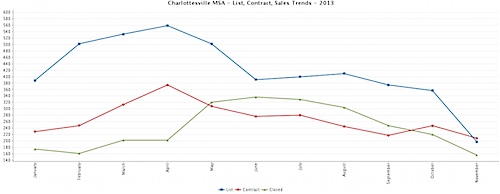

And 2013

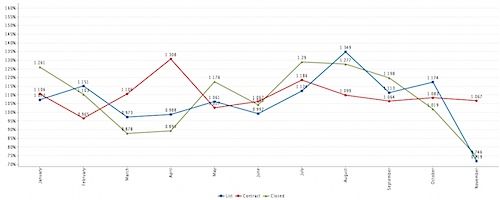

Well, this is interesting.

And the differential between 2013 and 2012.

Cash & FHA Transactions in Charlottesville MSA – Local Analysis Matters

Cash transactions in Charlottesville area – 2013

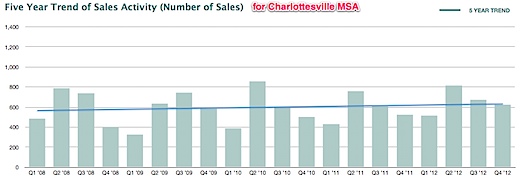

2012 is in the Past – Looking Forward at the 2013 Charlottesville Market

1 – Inventory is low – (good for sellers, not so good for buyers)

2 – Interest rates remain low

3 – Prices (in many market segments) have stopped dropping, and are largely increasing.

4 – Sales volume is up across the board

5 – As always, do your own, supporting due diligence; your market will vary.

Click through to read the full Nest Report.

April 2012 Charlottesville Real Estate Market Report

Highlights:

– Days on Market (an inherently flawed data point) are down in Charlottesville, Albemarle and Fluvanna.

– Average Sales prices are down (not surprising)

– Total sales across the MSA are down (not surprising)

Thoughts/initial conclusions:

– More buyers are looking to be closer in/closer to stuff

– Good properties are selling and selling quickly

– Interest rates remain low – a good thing for buyers.

– I think we may have pulled the spring market forward a bit; the early spring may have pulled transactions into the earlier months of the year.

Dead simple Takeaways:

– Buyers: do your due diligence, don’t let emotion enter the equation and make sound, rationale decisions with the intent of holding the property for at least five to seven years

– Sellers: do your due diligence and realize that buyers most often don’t have to buy, but want to buy – it’s your job to make them want to buy your house. This means: price, presentation, perfection … and a great location and setting.