Note: this was published yesterday on C-Ville.

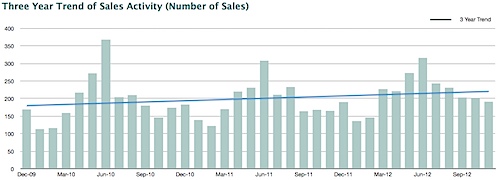

The past few years in real estate have been brutal, fascinating, and educational. 2012 is behind us and the 2013 market is picking up in Charlottesville. There are a few things to pay attention to when you’re looking at the real estate market in Central Virginia this year. (“So whats†are at the end):

– Inventory remains a key conversation point – quality inventory that people actually want to buy – has been consistently lower in Charlottesville and Albemarle than we’ve seen in years. “Quality inventory†defined as a home that is well-priced, in great condition, desirable locations.

-

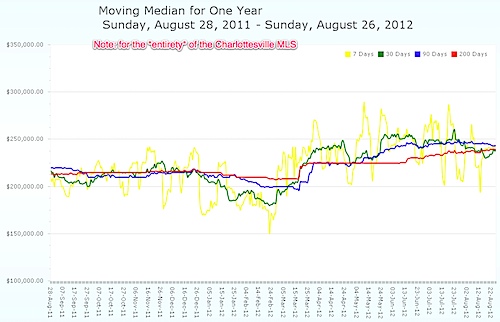

Home Prices* – Broadly speaking, if there is a glut of inventory fed by new construction and sellers who have been sitting on the sidelines for years, home prices will likely waver between stability and increasing. If good quality inventory comes and goes at a reasonable pace, home prices may rise, particularly as the market is fueled by ridiculously low interest rates.

-

Fewer distressed sales – As the market has continued to correct, banks have seemingly done a better job of selling off their inventory and facilitating short sales. Fewer distressed sales may lead to a more stable market. (Although, more homeowners may be distressed but unable to short sell and therefore unwilling to let their homes go to foreclosure).

-

More confidence in the market as unemployment stabilizes (underemployment is a different conversation). More stability is likely to mean more buyers

-

Frustration felt by buyers who are seeing prices rise (again). If prices do indeed start to rise again, many buyers will be kicking themselves for waiting. Some are predicting national home prices to rise by nearly 10% this year; if this happens (and I hope it doesn’t), expect to see more discussion about another bubble. But … if you’re confident you’re going to be in the Charlottesville area for the next 5-7 years, it might be worthwhile to have a conversation about buying a home.

-

Apartments – there are going to be a lot more available in 2013 and 2014. A few of the new complexes: Arden Place (Rio Road), The Pavilion at North Grounds (Millmont/UVA), Stonefield Commons (Hydraulic & 29), The Reserve at Belvedere (Rio), the Plaza on West Main (UVA), City Walk (Downtown – more on the Coal Tower). As I said, a lot more apartments will be coming on the market soon.