So … the the first half of 2012 is over. Everyone is looking for signs of recovery in the Charlottesville – Albemarle real estate market – in large part because they want/need the answer to one of these questions:

1 – Can I sell my house/condo/townhouse now?

2 – Can I feel comfortable buying a house now?

The answer to both questions is (as long time readers know): it depends.

Spend some time digging in the data; ask questions, but understand that as localized as this report is, your market – your part of the county, neighborhood, street even is likely to be not be covered by this report. For a true understanding of how you fit into the market, seek professional help (full-time, not part-time/hobbyist advice). Seriously. I do this every. Single. Day. and I can’t imagine trying to make decision or give advice unless I was living and breathing real estate stuff.

– The Days on Market, while an unreliable data point, are down

– The shift to single family homes continues – buyers are buying for longer timeframes – they are buying homes in which to live for 5, 7, 10, 20 years. Smaller condos and attached homes frequently don’t meet those goals.

– Fluvanna was hot. But – Fluvanna has challenges beyond the real estate market that will continue to affect the market and the locality.

– Home prices are up in many segments in the Charlottesville MSA

Sales volume is up, inventory is down.

But … lower housing inventory is not necessarily a sign of recovery.

Lest we get too confident, keep in mind that lower inventory is not necessarily a sign of a recovery; there are a lot of upside-down homeowners who would love to sell but can’t. Until we see appreciation to the point where they can sell, we’re not going to see a true recovery.

In smarter words:

… in markets with unusually tight inventory, prices are being “goosed†higher, not because the housing market is improving, but because there are fewer houses in the game. Low mortgage rates are artificially creating excess demand, with those buyers fighting over the slim pickings of sellers who can actually sell.

But you know what? There’s nothing we can do about that; the market is what it is. We can acknowledge it and make the best decisions possible with the information, data and analysis available.

See:

– Brookings Institution’s Metro Monitor

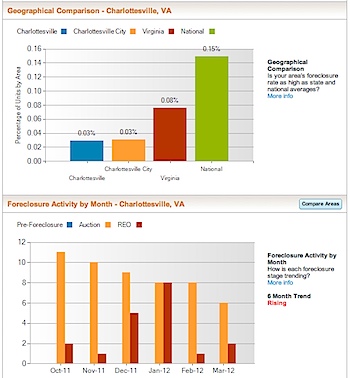

– Corelogic’s most recent negative equity report (4Q 2011) shows that Virginia has 23% negative equity and 6% “near negative equity.” Lamentably we don’t have more localized data to the Charlottesville MSA. These numbers feel about right (broadly) for Charlottesville though; Fluvanna’s going to be different than Charlottesville and some condos are different than single family …

– Foreclosure Supply and the Housing Market –

Mark Hanson makes some interesting points, and this raises the question again of why supply has fallen so sharply. There are probably several reasons for the decline in supply: 1) negative equity keeps people from selling (and buying as Hanson notes), 2) banks aren’t foreclosing quickly and are focusing more on modifications and short sales, 3) cash-flow investors have purchased a substantial number of houses, especially at the low end, and they will not be sellers for some time, and 4) seller price expectations (when sellers expect prices to stabilize, they no longer rush to sell).