I know I’m a broken record. I get a tremendous amount of value from the National Association of Realtors – from their publications (On Common Ground is tremendous), to the lobbying they do to the information they share … but as far as home sales data and projections, I don’t understand why there is so much gnashing of teeth and complaining about the NAR’s projections and data. The NAR is a trade organization for Realtors. I’m not bashing the NAR, but I would like to see their analysis put in the appropriate context.

Understanding the Charlottesville area real estate market is a full-time job – representing buyers and sellers, analyzing the market, etc.; making sense of the nation’s housing market – I’d go so far as to say it’s impossible to do accurately or credibly.

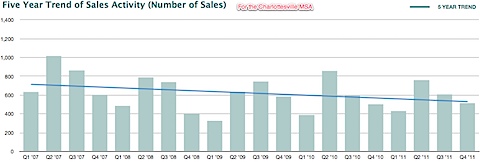

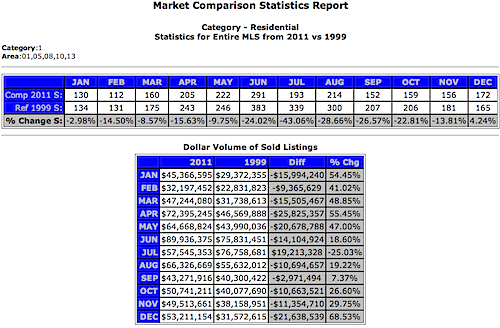

For a brief summary of where we are in Charlottesville:

Nest’s January 2012 Real Estate Summary

And the “Market Statistics” category in RealCentralVA. Or, better yet, if you have a question about the market, start your research looking at the broader market statistics and then, ask me.

To see the responses to the title question from those on Twitter, read the rest of the story.