Albemarle, Augusta, Bath, Buena Vista City, Charlottesville City, Fluvanna, Greene, Harrisonburg City, Highland, Lexington City, Nelson, Rockbridge, Rockingham,Staunton City,Waynesboro City

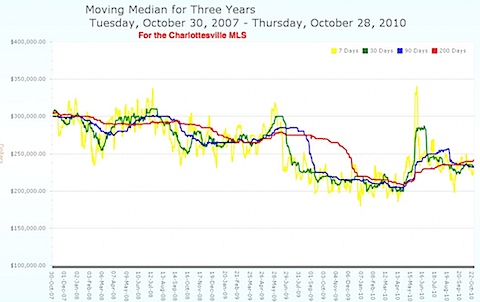

This is the moving median average price for homes in the Charlottesville MLS for the past four years.  – So for all intents and purposes, the report is somewhat irrelevant as it speaks to such a broad region. – Because Virginia is a non-judicial state, we most likely won’t be affected by the robo-signing issues. – Analysis of past two recessions compared to this one. This recessions’ recovery is stronger than 1991 and 2001, doesn’t feel like it due to in part to consumer confidence . – Three consecutive months of positive job growth in the state.

– So for all intents and purposes, the report is somewhat irrelevant as it speaks to such a broad region. – Because Virginia is a non-judicial state, we most likely won’t be affected by the robo-signing issues. – Analysis of past two recessions compared to this one. This recessions’ recovery is stronger than 1991 and 2001, doesn’t feel like it due to in part to consumer confidence . – Three consecutive months of positive job growth in the state.

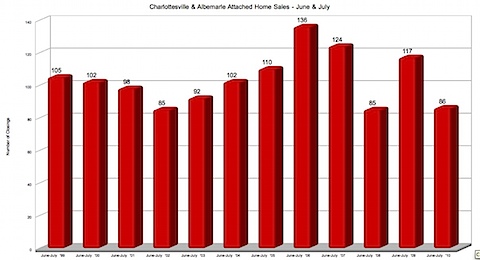

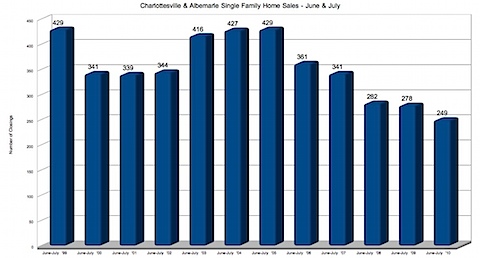

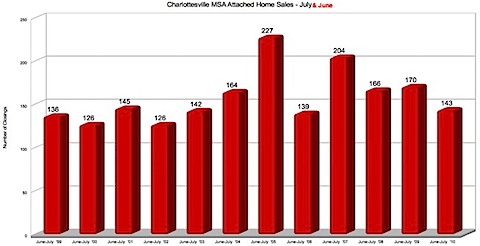

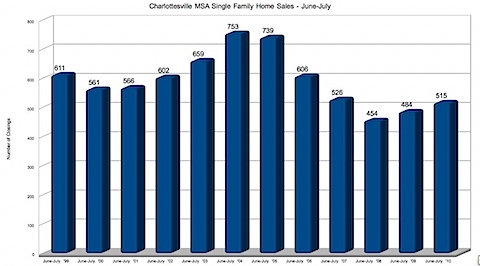

… Virginia Association of Realtors 3rd Quarter 2010 Home sales press release (PDF) and I’ll post the podcast when it’s up. Sales and Inventory for homes in Charlottesville MSA (PDF) — Check out the new graphs at the bottom .