If you’re thinking about buying or selling in the Charlottesville area or curious or interested in the Charlottesville (and regional/national) real estate market, you might find some value in listening to this Sunday’s WNRN Wake-Up Call.

Matt Hodges and I will discuss the current state of the Charlottesville area real estate market, mortgages, tips for buyers and sellers, etc. We’ve done this every year for the past six years and every year each time has produced conversations. If you’re interested in us talking about something specific, please leave a comment or let me know.

Matt’s initial notes of stuff to talk about:

– Ability-to-Repay and Qualified Mortgages

– Recent Bureau of Labor Statistics payroll releases, 2/6 release and what it means to borrowers out there + Federal Reserves tapering decision and what it means

– Predicted increases in rates to 5 – 5.5% and how that affects ability to purchase vis a vis today’s rates

My initial notes of stuff to talk about:

– Brief market update

– How new mortgage laws may impact buyers’ and sellers’ decisions

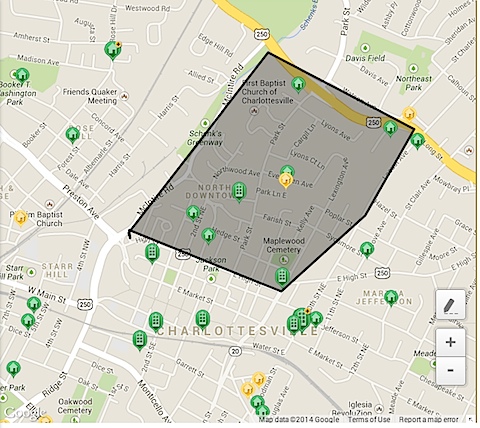

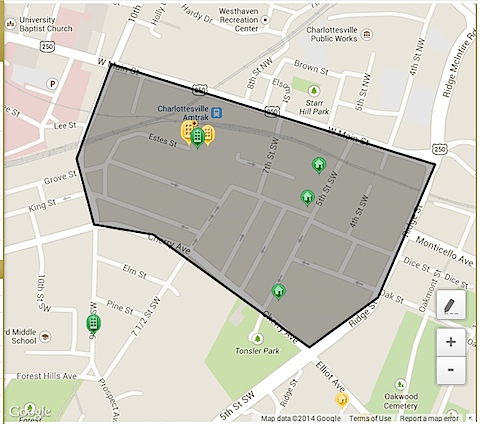

– Current massive growth and density in the City of Charlottesville

– What buyers should be doing right now who are planning to buy this year

– What sellers should be doing right now who are planning/hoping to sell this year

– Inventory levels in the Charlottesville MSA