Update 1 October 2013:

From the NAR’s page:

Federal Housing Administration

HUD’s Contingency Plan states that FHA will endorse new loans in the Single Family Mortgage Loan Program, but it will not make new commitments in the Multi-family Program during the shutdown. FHA will maintain operational activities including paying claims and collecting premiums. Management & Marketing (M&M) Contractors managing the REO portfolio can continue to operate. You can expect some delays with FHA processing.

Update 2, 1 October 2013 – lending seems to be ok in face of the shutdown, for the most part. A greater challenge will be the IRS –

A less-talked about impact of the shutdown on housing is the impact on the Internal Revenue Service (IRS) and the Social Security Administration (SSA). The IRS has announced they will not process any forms, including the issuing of tax return transcripts (Form 4506 T). The Social Security Administration will retain a skeleton staff, but may prioritize new claims, resulting in difficulties in verifying Social Security numbers.

Some lenders and brokers have been able to race to get these documents certified for loans they currently have in the pipeline before the shutdown.

…

But new mortgage applications may face delays without these crucial documents. So far, secondary market participants, including Fannie and Freddie, have been unwilling to alter or suspend overlay requirements which require these documents in order for a loan to be sold onto their books.

The biggest threat is uncertainty. And decreased confidence in the market and the government. That said …

So the government might shut down … so what? (with respect to real estate). VAR Buzz has a starter:

Fannie and Freddie will continue to operate. They aren’t funded by the government; they make their money via fees.

However, FHA, VA, and USDA loan applications won’t be processed.

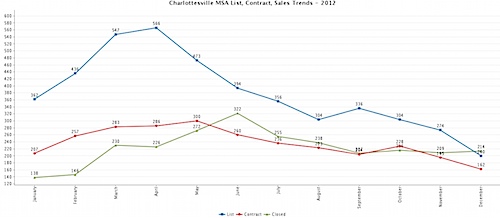

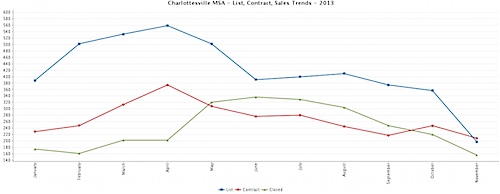

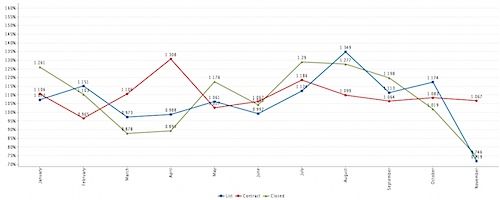

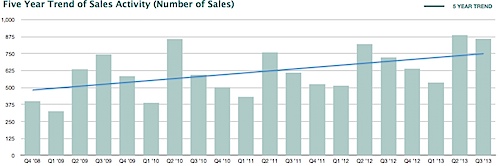

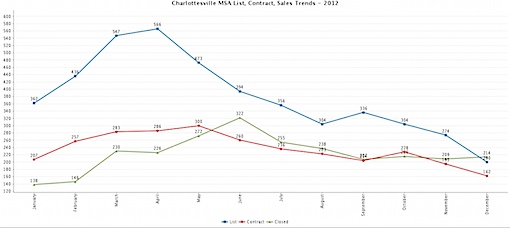

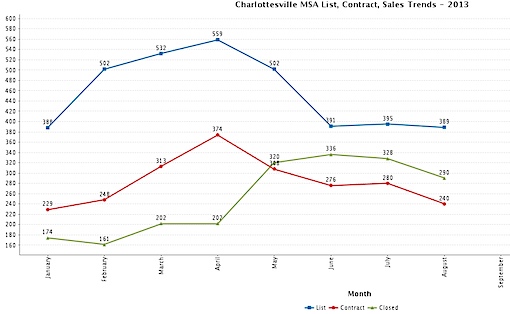

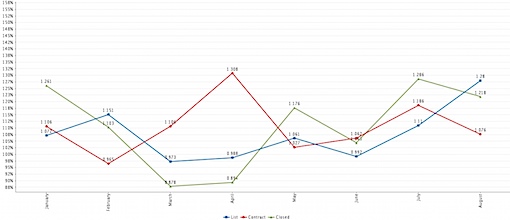

Using current data from the Charlottesville MLS, about 18% of all transactions in the Charlottesville MSA would be potentially directly affected by a government shutdown, assuming the above is accurate (and I believe it is). Again, right now, there appear to be about 500 homes under contract in the Charlottesville MSA. Carry out the math and we’re looking at about 100 transactions likely to be affected.

CNN:

If an application for an FHA-insured loan has not been approved by the time of the shutdown, it will have to wait until after the shutdown ends.

FHA-backed loans accounted for 45% of all mortgages used to purchase homes issued in 2012, according to the Federal Reserve. The FHA alone insures about 60,000 loans a month.

FHA loans in Charlottesville presumably account for nearly 9% of transactions. So far this year, per the Charlottesville MLS, VA loans have made up about 6% of all transactions, USDA about 4%.

Nearly 20% of transactions might not seem like a lot – until you’re one of those FHA, VA or USDA buyers – or sellers waiting for the FHA loan to fund and close. Then that’s all that matters. Everything is affected when these are delayed – movers, attorneys, real estate agents, utilities, jobs, schools, household goods – everything.

Update: per @rqd and then USA Today – more uncertainty.

43. Does that mean I can’t get an FHA mortgage? No. The Federal Housing Administration says it “will endorse new loans under current multi-year appropriation authority in order to support the health and stability of the U.S. mortgage market.”

44. Does that mean I can’t get a VA mortgage? No. The Department of Veterans Affairs says loans are funded via user fees and should continue. However, during the last shutdown, “loan Guaranty certificates of eligibility and certificates of reasonable value were delayed.”

Some of the things I’m reading this morning trying to educate myself:

Read More