Sometimes a post in which I pull data to answer a question becomes a bit more than intended. This is such a post.

– Do sellers pay closing costs? – Are we at a sustainable volume of closed transactions? – FHA is helping foreclosed buyers.

Do the sellers pay closing costs? Is one of the more common questions I get, whether I’m representing buyers or sellers.

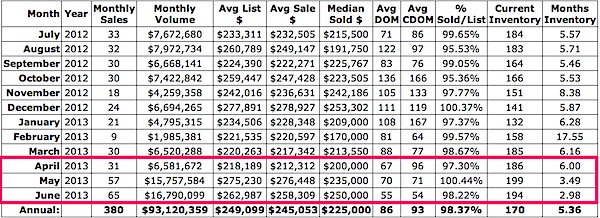

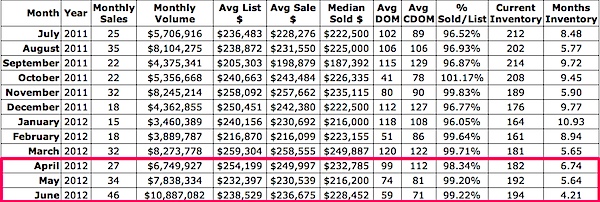

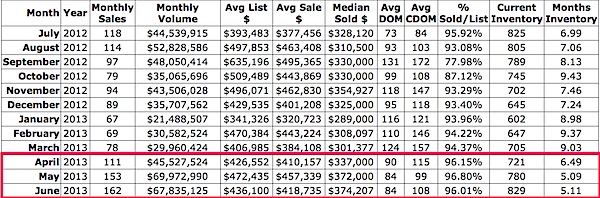

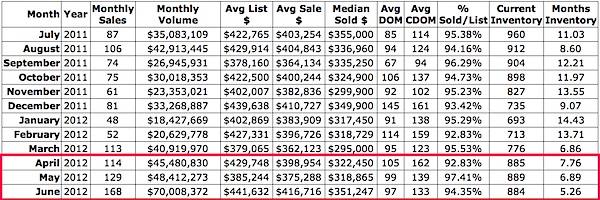

A quick look at 2013 so far, 1991 homes have sold in Charlottesville, Albemarle, Fluvanna, Greene, Louisa, Nelson. Of those, 518 have something entered into the “seller concessions” field in the Charlottesville MLS, so presumably, about 26% of transactions this year have had some sort of seller concessions.

Last year those numbers were 1,864, 556 and 29%, respectively.**

But really .. what do “seller concessions” mean?

– The seller “paid” the buyers’ closing costs. (not really)

– The buyer is financing the closing costs over the life of the loan.

in other words:

– The seller is accepting a lower net offer

– The buyer is paying a higher net offer.

For example – if a seller is asking $450k and the buyer offers $440k with the seller “paying” $10k towards the buyers’ closing costs, the seller is looking at a net offer of $430k. The seller doesn’t care how that’s structured; they’re looking at a net offer of $430k.

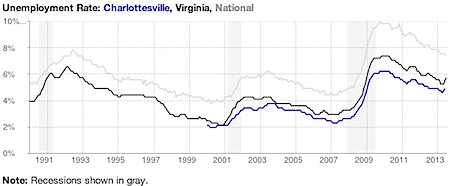

** Just because I’m naturally curious, I looked at the number of closed transactions in the Charlottesville MSA in the January – August timeframe in 2007 … 2,336. And 2006 … 2,824. So, from a pure volume perspective, our market is down 30% from the peak. As noted in 2012 – I’ll Know Housing Recovery in Charlottesville When I’ve Seen It

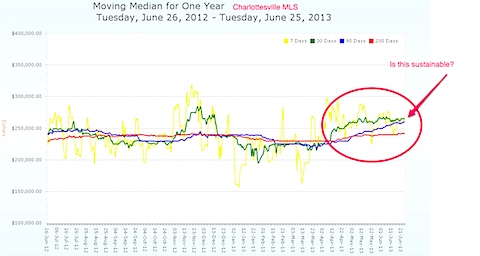

Transactions – volume of transactions – what is normal volume of sales transactions in the Charlottesville MSA? I don’t know; homeownership rates are declining. Last year, 1755 single family homes sold in the Charlottesville MSA (including Louisa). In 2002, 2479 single family homes sold. I’d put the “sustainable” rate of single family home sales somewhere in between those two numbers.

We might be getting close to a sustainable recovery.

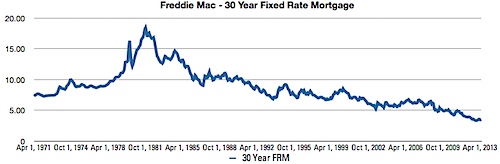

One sign of the recovery that I called years ago? Those who were foreclosed on are now eligible for new loans – a year after foreclosure.