The Questions:

– Can I sell my house in Charlottesville (area) right now?

– Should I buy a house in Charlottesville (area) right now?

Answer to both: It depends.

Buyers: If you need to live somewhere and know you’re going to be somewhere for at least 5-7 years, now might be a great time to buy … ** interest rates remain extremely low. But … there is a dearth of quality inventory on the market right now. I’m finding that buyers are searching for (much) longer timeframes, so that when the right house does come on the market, they are prepared. Start early; do your research and be prepared to move quickly when the right house comes on the market.

Sellers: If you need/want to sell, understand that buyers are still looking for quality and value … and that selling a home is work. (It’s hard work; I task my seller clients with loads of prep work) , but know this: unless your home is one that is priced and conditioned to sell in two weeks, be prepared to be patient. And to defend your price with data and facts, not emotions and expectations — neither buyers nor appraisers care about what you need/want to make or how much the house is worth to you.

Year over year:

(Inventory level = # of homes on the market)

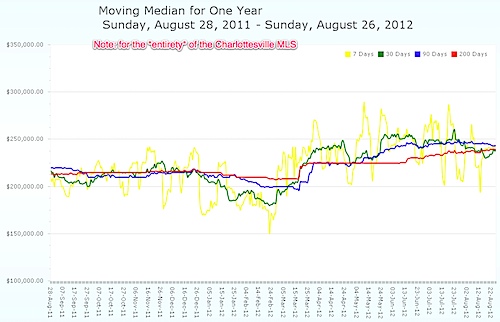

Charlottesville – Inventory level is down nearly 20%, median price is up slightly to $255k – up about 7% (but still way below 2010)

Albemarle – Inventory level is down a bit, median price is up about 5%

Fluvanna – Inventory is down about 8%, as is the median price.

Greene – Inventory is down a little and the median price is up significantly – about 30% … keep in mind that this increase was based on 11 closed sales this July versus 19 the previous July.

Louisa – Inventory down about 23% while the median price down nearly 20%

Nelson – Always an inconsistent market due to the variety of product mix there … Inventory is down about 12% while median price is down 24%.

The takeaways from this month’s look at “what’s happening in the Charlottesville real estate market”:

1 – In some segments of the Charlottesville – Albemarle MSA (Metropolitan Statistical Area), the buyers’ market looks like it’s over. Good houses that are priced well are moving … sometimes in a matter of days and occasionally with multiple offers. Inventory is down, some prices are up. (Low Inventory isn’t necessarily a sign of recovery though)

2 – Foreclosures and short sales are still out there, and are seemingly comprising a smaller portion of the market than we’ve seen over the past few years. But there are anecdotes everywhere – I almost showed a short sale in Albemarle in which the asking price is $450k … down from the initial asking price was $1.19 million … in 2008.

3 – I don’t feel like a complete fool saying that the recovery is near. I don’t know when “near” is, but I do know that “normal” is a moving and shifting target. “New normal” is an absurd term; today is normal. So is tomorrow. So is yesterday.

4 – Product mix shift – anecdotally, we’ve seen this coming, but we’re seeing more and more buyers are opting for single family detached homes as opposed to attached homes. Condo volume seems to be stabilizing … the condo buyer of today is more interested in the condo lifestyle (location, no maintenance or yard work) than we saw in the previous market*. What we’re also seeing is a demand for the condo lifestyle in single family homes; that solution doesn’t really exist yet, but there’s a market for it!

5 – Real estate market Data is but part of the conversation and analysis – experience and conversations with other experienced real estate agents matters tremendously. It might sound silly to in-lookers, but being able to tell that a property is great and will sell soon is crucial. Example: I showed a house on Saturday and told my buyer clients that I expected it to sell in the “next couple days” … then I heard Monday that the sellers got three offers. That insight comes from experience, not just looking at data. … and educating my buyers so that they are able to discern a well-priced, well-marketed home is one of my favorite things.

Read More