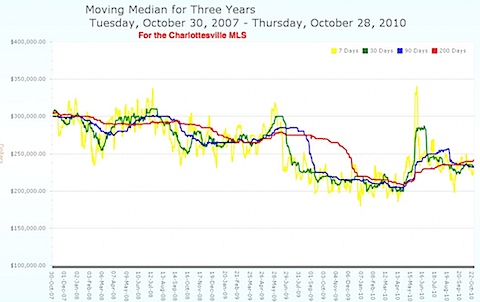

Looking at the number of transactions so far this year* in the Charlottesville MSA – Charlottesville, Albemarle, Fluvanna, Greene, Nelson – for all kinds of property – condo, attached, single family, farms … in this dataset there are going to be outliers and anomalies, but with a set this large, we’re really looking for trending analysis. … Maybe we are witnessing the “new normal” for the Charlottesville real estate market, and it’s something that we’re just going to have to get used to.

…While dramatic increases in productivity could theoretically take up the slack, that may be too much to ask of a generation whose education, for the first time in American history, ranked in the bottom third of developed nations. … “The trend is most visible,†they write, “in the transition from a G-7 to a Group of 20 model of international decision making which includes influential and deep-pocketed developing countries like Brazil, China, India, Saudi Arabia and the United Arab Emirates.

Read More

I’ll let you know in 2013 if they’re right.

I’ll let you know in 2013 if they’re right.