The housing recovery in Charlottesville (and presumably everywhere, but knowing this market is hard enough) is kind of like pornography.

I shall not today attempt further to define the kinds of material I understand to be embraced within that shorthand description [“hard-core pornography”]; and perhaps I could never succeed in intelligibly doing so. But I know it when I see it, and the motion picture involved in this case is not that. [Emphasis added.]

—Justice Potter Stewart, concurring opinion in Jacobellis v. Ohio 378 U.S. 184 (1964), regarding possible obscenity in The Lovers.

How will the “recovery” be defined? Is now the time to buy? (or sell?)

First, we’ll know by hindsight. When we have the luxury and the benefit of 12 to 24 months of looking back, we’ll be able to tell.

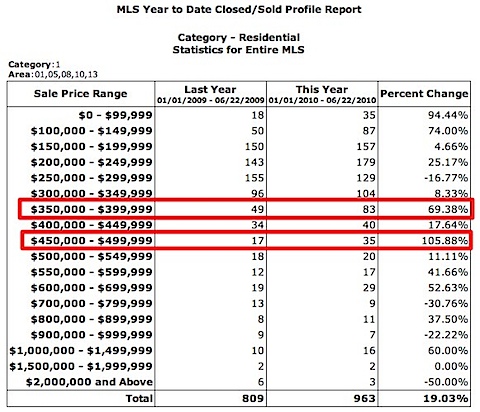

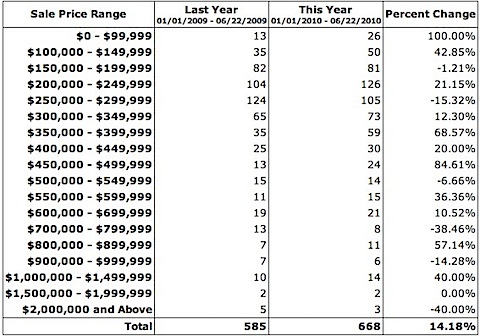

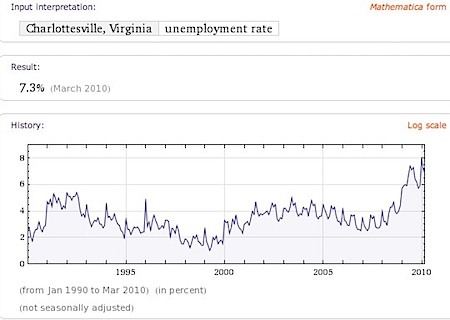

Transactions – volume of transactions – what is normal volume of sales transactions in the Charlottesville MSA? I don’t know; homeownership rates are declining. Last year, 1755 single family homes sold in the Charlottesville MSA (including Louisa). In 2002, 2479 single family homes sold. I’d put the “sustainable” rate of single family home sales somewhere in between those two numbers.

Price – stability or appreciation showing themselves

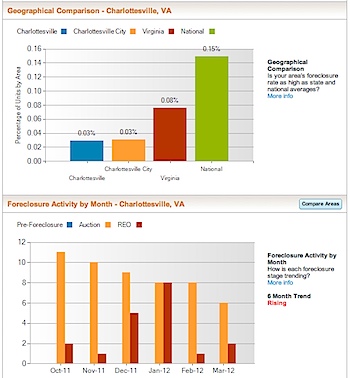

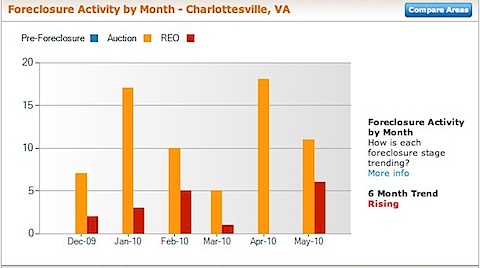

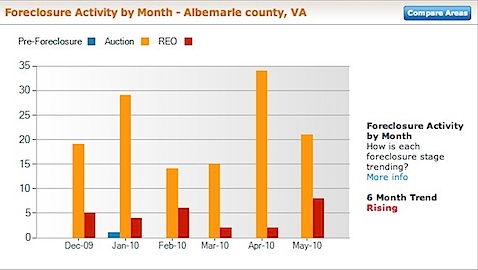

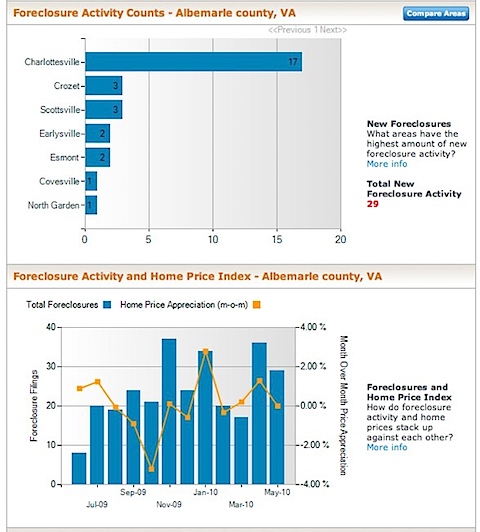

Foreclosures and short sales – fewer than today to none.

Shadow inventory – known and dispensed with; no longer a question of uncertainty.

So … is the housing market in Charlottesville recovering?

Calculated Risk says:

The debate is now about the strength of the recovery, not whether there is a recovery. My view is housing will remain sluggish for some time, and I expect 2012 to be another historically weak year, but better than 2011.

Maybe.

Consider this snapshot, from which I’m trying to :

In Charlottesville and Albemarle:

– 107 homes went under contract between 15 April and 1 May 2011. 64 of those were single family. 23 were attached.

– 144 homes went under contract between 15 April and 1 May 2012 – a 26% increase! – 92 (30% more) were single family. 23 were attached.

In the Charlottesville MSA (Charlottesville, Albemarle, Fluvanna, Greene, Louisa, Nelson):

– 156 homes went under contract between 15 April and 1 May 2011. 109 (70%) were single family.

– 186 homes went under contract between 15 April and 1 May 2012. 132 (71%) of those were single family.

That sure looks like we’re on the path to recovery, right?

In the MSA in the above timeframe, 22 of those contracts in 2011 were either short sales or foreclosures (6 & 16, respectively). In 2012, 19 of those were short sales or foreclosures (8 & 11, respectively). “A 14% decline in distressed contracts!” surely is a better headline than “3“, right?

It’s too early to tell with respect to foreclosures/short sales/distressed sales

My personal favorite:

“When will U.S. house prices recover? Likely never. But that’s no reason not to buy.” and believe it or not, the article reaches some salient conclusions, echoed by many if not most of my recent buyer clients’ decisions –

That’s why prospective buyers should stop focusing on the vague hope that house prices will jump from here and focus instead on the functional value houses provide for the money. In most markets, they provide enough of that to make buying a good deal.