Effective for FHA loans for which the case number is assigned on or after October 4, 2010, FHA upfront and annual MIP will change as follows: – Upfront MIP – 1.00% on ALL mortgage terms (from 2.25%)

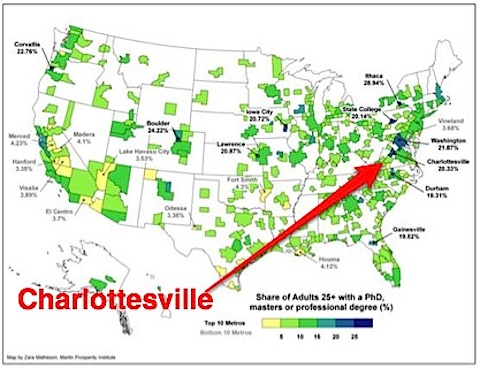

… – Annual MIP – 0.85% for LTVs less than or equal to 95% and terms of more than 15yrs (from .50%) * No Change in Annual MIP for <=15yr Terms (No Annual MI) In general, monthly payments are going to INCREASE due to the higher annual MI payment. ** LTV = Loan to Value (the above was sent along by Jason Crigler with Crown Mortgage ) Keep in mind that the FHA loan limits for the Charlottesville MSA are: Single Family/Attached – $437,000 Two family – $559,450 Three Family – $676,200 Four Family – $840,400 For an example of what these increases mean you homebuyers in Charlottesville, I’m going to borrow Rhonda Porter’s math : Using an interest rate of 4.25% and a based loan amount of $400,000; it looks like this: FHA Case Number BEFORE September 7 October 10, 2010:

… $400,000 plus $4,000 = $404,000 amortized for 30 years at 4.25% = principal and interest of $1,987.44 plus the annual mortgage insurance of $300 = $2,287.44.