I figured the assessments would be released yesterday; I was trying to research a property for a client and the Albemarle County GIS site was down. It’s up now.

If you’re curious what real estate assessments mean, this is a good description from a couple years ago.

Assessments are not a reflection of market value. They are a backward-looking assessment of what the market value may have been at the time the assessor looked at the house (most likely online, and not in person). The assessor may or may not know the condition of the property, the condition of the property’s neighbors, may not consider the traffic noise, crime stats, proximity of sexual offenders, level of inventory, smell of the neighborhood, etc. etc. etc. Assessments are why you pay taxes on.

2013’s post on Albemarle County assessments in which I recounted the previous years’ posts on assessments. I won’t re-link them again today, but I will re-state what I wrote last year:

5 Reasons why real estate assessments matter:

1) The County bases their budget on property tax revenue.

2) The assessed value is the value upon which property owners pay taxes.

3) Buyers look at assessed values as a measure of market value … but really, it’s a point in the equation, but are neither a definitive point nor a necessarily accurate one.

4) Also – Virginia, unlike some other states, by Statute requires localities to assess property at 100% of fair market value, based on an objective analysis of the property’s fair market value.

5) Sellers look at assessed values and wonder if buyers will think that the assessment means their home is worth X (it doesn’t).

When the County sends out their press release describing the breakdowns of assessed value by region within Albemarle, I’ll post it.* My assessment is up 14%; I’m curious to see what the general trends county-wide turn out to be.

As promised, the County’s press release:

Albemarle County is sending 2014 reassessment notices to taxpayers this week reflecting changes in property values resulting from the County’s recently completed annual reassessment. The 2014 reassessments show changes in property values resulting from stabilization of the real estate market being experienced locally as well as nationwide. The change in the County’s total “Fair Market Value” base has increased by 1.28% over the 2013 base. Reassessment changes by property type are:

– residential (less than 1 acre)- up +1.98%

– residential (1 acre to 19.99 acres) – up +0.40%

– rural (20 to 99.99 acres) – down -0.14%

– rural (100 acres and over) – down -0.29%

– commercial property – up +3.64%

– multi-family – up +0.99%

As indicated above, results for different property types may vary significantly from the overall percentage decline. The reassessment figure reflects the values of existing properties and does not include the value of new construction. New construction is valued at $100,000,000 for the reassessment period.

Virginia by Statute requires localities to assess property at 100% of fair market value, based on an objective analysis of the property’s fair market value, independent of any influence on the part of the County or the County Board of Supervisors. Albemarle County continues to consistently rank among the most accurate jurisdictions in statewide Assessment/Sales Ratio studies conducted by the Virginia Department of Taxation.

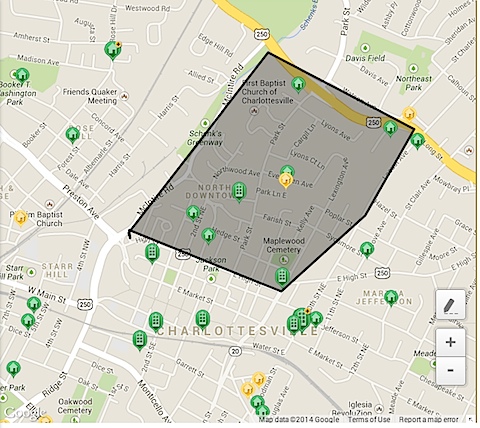

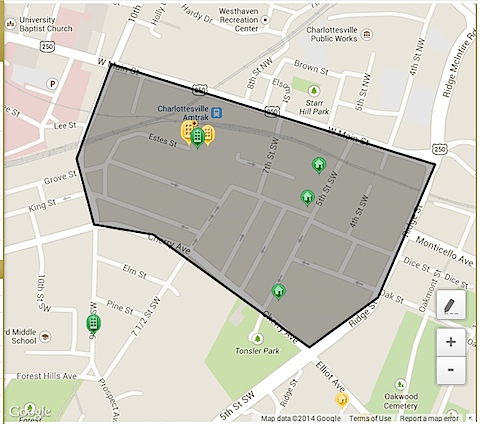

The average annual reassessment changes for the magisterial districts are as follows:

Rio – +1.75%

Jack Jouett – +3.64 %

Rivanna – +2.85 %

Samuel Miller – +1.58 %

Scottsville – +0.27 %

White Hall – +0.49 %

Town of Scottsville – +1.49 %

The new assessments will be reflected in the real estate bills which will be mailed in late April, 2014. County officials recommend that anyone who would like more information or who wishes a review of their assessment to contact the Office of the County Assessor at(434) 296-5856. Real estate assessment information can be found on the County’s Website, www.albemarle.org, under Online Services, GIS-Web. Among information available are property descriptions, maps and sales information. The Assessor’s Office provides computers that can be used by the public during normal business hours.

There is a process in place to appeal disputed reassessments. As a first step, taxpayers are encouraged to contact the Assessor’s Office to insure the correctness of County records and to receive an explanation of the basis upon which the valuation was made. The deadline for requesting a review with the Assessor’s Office is February 28, 2014. The Assessor’s Office recommends that citizens make an appointment as walk-in are handled on a first come first serve basis. If a property owner does not receive satisfaction with this step, further appeal may be directed to the Board of Equalization appointed by the Board of Supervisors, which is comprised of Albemarle County citizens who have completed training by the Virginia Department of Taxation and who meet on a regular basis. All appeals to the Board of Equalization must be filed by March 17, 2014.

Applications for properties qualifying for land use assessments will be accepted until March 1, 2014. A new application, per parcel, is needed to enroll in the program or when a property enrolled has a change of use of acreage from that previously qualified. A new application is not needed if your property is currently qualified in the land use assessment program.

Read More