Because this is what I passed Saturday morning on my drive from showing a client house in White Hall to meet another client in Ivy.

Posts tagged Albemarle

UVA’s Firing Range near Glenmore – Balancing Growth with Long-Term Firing Range

UVA has had a firing range for a long, long time. Residents of the Glenmore neighborhood don’t like listening to it, so they’ve asked UVA for either a quieter range or for it to be moved. UVA, being state-owned, “is not required to seek permission from the county for construction on land it owns.”

Enter stalemate.

And yet –

A question came to me that I’ve been wondering for months –

Has this matter hurt Glenmore house prices yet?

I must say I wouldn’t dream of moving there after learning about this problem.

And this, readers, is why it is absolutely critical for buyers to do their own research on homes and neighborhoods and surroundings; real estate agents (I am one, but I do my absolute best to educate my clients about such matters) are not obligated to discuss/disclose matters outside the four corners of the subject property.

UVa’s in a tough spot – they’ve been there for many decades, while Glenmore has existed since the early ’90s, yet it seems that the recent “improvements” amplified the sound.

Compromise: why don’t UVa and Glenmore split the cost to implement the necessary solution?

Tuesday Morning Reads – 28 August 2012

– Gentrification and Charlottesville – C-Ville – My favorite line of the week: “If Austin is fighting to stay weird, let’s us fight to stay a little bit country.”

– Charlottesville Chamber of Commerce Releases 2012 Jobs Report – NBC29 (and here’s the actual report)

– VDOT releases draft environmental assessment for Western Bypass – Charlottesville Tomorrow

– Latest trend in house design: “A home within a home” – Treehugger – for the boomerang kids or returning parents.

– Dear Internet – where should I live? — None of these are particularly accurate to Charlottesville, although WalkScore is accurate enough to ballpark walkability.

– How Young Homeowners Lost Out by Buying – The Atlantic – This is but another reason that I think a true “recovery” won’t be seen for at least 3-5 years.

– Why Home Prices Are Rising: The ‘Distressed Share’ – We’re definitely seeing this emerging in Charlottesville

(Some) Real Estate Prices up in Charlottesville and Albemarle

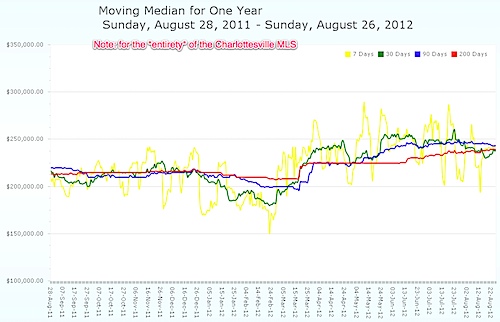

Looking at some real estate data the other day, I came to a conclusion: for some segments of the Charlottesville real estate market, we might actually be in the “bottom” – bottom meaning that prices are either not declining anymore or are in fact, wait for it … rising.

This belief was bolstered further when I looked at some of the numbers –

May, June, July – for the Charlottesville MSA, Year over Year:

– 777 homes (condo, single family, town home) sold this year versus 709 last year – an increase in volume of nearly 9%

– Median Price was up about 5% to $261,645

For the County of Albemarle:

– 418 homes sold versus 375 in this period last year; an increase of about 10%

– Median price was up nearly 12%

For the City of Charlottesville:

– 230 homes sold this year versus 146 last May, June, July; an increase of ~15%

– Median price in the City of Charlottesville rose nearly 8%.

BUT

There are still a lot of people in this market who cannot sell and not lose money – and I think this is going to remain the case for several years. Yes, the above news and data are very positive, and if you’re looking to buy and know you’re going to be here for several years, now could be a tremendous time to buy – you might lament your delay. But … every real estate market is local – down to the individual – and specific.

A Day in Crozet

He makes Crozet sound like such a great place to live. I’m betting that the suggestions from Crozetians led to his having a more productive (and fun) day.

C-Ville + WordPress = Great New Site

C-Ville discovers Wordpress, and the result is pretty slick. Simple, clean design, great font, disqus commenting …

I love that they kept things local:

Ryan DeRose and his company Vibethink—a one-man team when we signed them up, and a five-person shop on the Downtown Mall now—built the new version of c-ville.com. Ryan and Matt Clark, who also worked closely with us, attended Western Albemarle and Nelson County high schools, respectively, so we kept things local. What really sold us on their team was that they shared our ideas about what makes a good local media site, and they cared about our paper’s role in the community. We wanted to make something that was easy to use (for us and for you); we wanted to strip away unnecessary distractions from the content; and we wanted to create a platform that we could constantly modify and improve as things changed. We wanted a site that would show up well on all your devices, that integrated social media seamlessly, and that showcased our photographers and writers.

Charlottesville Bubble Bloggers’ Take on the Current State of the Market

It’s not often that I say something is a “must read”, but the Charlottesville Bubble Bloggers’ “Carpe Diem” Trumps “Caveat Emptor” As “Bottom” and “Recovery” Chatter Increase in the Charlottesville Real Estate Market Mid 2012 is such a post.

Broadly-sourced, logically articulated, they debunk a lot of the myths and stories underlying the Charlottesville real estate market – from shadow inventory to Charlottesville’s “protected” nature, to reduced inventories, home prices and more. I highly recommend reading it.

Their closing echoes much of what I have been saying here and in conversations with clients for months:

But for those who have been waiting to buy and waiting to sell, there’s more clarity than ever. The 30 year fixed rate mortgage is currently at 3.6% (Aug. 15). Buyers who have waited for years and are well-cushioned financially aren’t looking at a house as an investment but as a home. For those with stable jobs and a 7-10 year event horizon plus a capacity to absorb price wobbles, buying looks attractive. And there are many equity sellers getting off the fence, realizing that they’ll never get that dream of the missed bubble price: but acknowledging that moving on or moving up and getting things settled has a value greater than money.

If you’re going to buy a home in Charlottesville, understand that now is normal, or as an agent said to me several years ago: “It doesn’t matter whether the real estate market is ‘good’ or ‘bad’ – it is.

And so it is.