1 – Boulder, CO 2 -Ann Arbor, MI 3 – Washingon, DC 4 – San Jose, CA 5 – San Francisco, CA 6 – Southern Connecticut 7 – Charlottesville, VA Charlottesville, Va. MSA – ed. note: Charlottesville, Albemarle, Fluvanna, Greene, Nelson (and also, but not technically, Louisa) Adult population: 123,269 Bachelor’s degrees: 29,038 (24%) Master’s degrees: 13,970 (11%) Professional degrees: 4,722 (4%) Doctorates: 4,817 (4%) It’s said that the greatest gathering of human knowledge in the White House occurred when Thomas Jefferson dined alone.

Posts tagged charlalbemarle

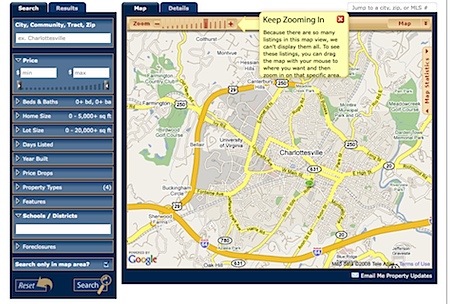

Update on New MLS Search Tool

Here’s what I’m seeing so far – 1 – All the photos and virtual tours still aren’t coming over – I think this may have something to do with the type of feed they’re using, but we’ll sort it out soon. … I’m going to do a post in the next couple of days highlighting some of the key features of the search – search by MLS number, how each listing has a permanent link that you can email to your friends (or use in a blog post 🙂 ) …

As Promised – A New Way to Search For Homes in Charlottesville

After watching my friends Jay in Phoenix and Kris in San Diego do such wonderful things with their MLS search tools, I’m finally able to announce what I believe to be the single best tool to search for homes in the Charlottesville, Virginia area* – Since founding RealCentralVA in 2005, I have never put a “Search for Homes” thing on my blog because none of the ones available had what I wanted; the technology is finally here (and it’s groundbreaking in the real estate community, but not necessarily the technology community) 🙂 –

– Get alerts sent to you via Email or RSS – Search by multiple School District – eventually you should be able to search by more than one school district – Search by Price Drops – ex: 10% in the past 10 days – and indication an property may finally be priced right – Search by Foreclosure/Pre-Foreclosure status (still testing this one for its validity) – Save your searches!

– Get alerts sent to you via Email or RSS – Search by multiple School District – eventually you should be able to search by more than one school district – Search by Price Drops – ex: 10% in the past 10 days – and indication an property may finally be priced right – Search by Foreclosure/Pre-Foreclosure status (still testing this one for its validity) – Save your searches!

Foreclosures in Charlottesville – Answers to some of the Questions

Foreclosure : This is the auction process by which the lender attempts to do 2 things: obtain clear title to the property by wiping out liens and obligations recorded after the instrument, and occasionally accepting a successful bid that pays all or part of what they are owed. … Often the lender will instruct the trustee to make a bid on it’s behalf that is somewhere very near the amount they are owed, in hopes that someone will either bid higher and they will be made whole, or that once they have clear title, they can then resell and hopefully mitigate their loss.

New Appraisal Issues Affect Realtors

When the Federal Housing Finance Agency (FHFA) was appointed conservator of FNMA/Freddie, implementation of the HVCC was pushed back to next year, but you can expect that the appraisal portion of your closing process will be different when it is implemented next year. … In the last week alone, we have been hired to reappraise two properties where the underwriter felt that the original appraisals, conducted at a lowball fee by someone else, simply did not provide enough detailed information to allow a decision.

A Great Time to Buy! (a house in Charlottesville)

They didn’t invest in an ATM; they’re not getting a HELOC to finance their burgeoning real estate investment club, and I suspect they won’t be pulling money out of the house to buy a new car to keep up with the Jones. … All I can do as a Buyer’s Agent is advise my clients as to the current state of the market, what the comps ( more active and under contract than sold ) indicate is a fair price, and manage and guide them through the transaction.