Foreclosure : This is the auction process by which the lender attempts to do 2 things: obtain clear title to the property by wiping out liens and obligations recorded after the instrument, and occasionally accepting a successful bid that pays all or part of what they are owed. … Often the lender will instruct the trustee to make a bid on it’s behalf that is somewhere very near the amount they are owed, in hopes that someone will either bid higher and they will be made whole, or that once they have clear title, they can then resell and hopefully mitigate their loss.

Posts tagged foreclosure

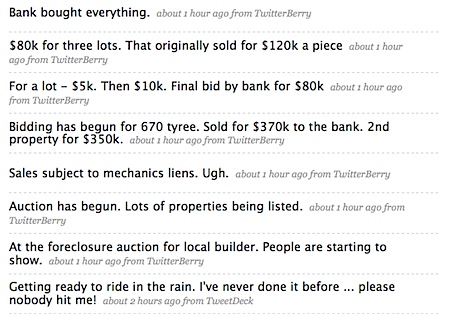

This is What a Foreclosure Auction Looks like in Charlottesville

It was actually quite boring until you think about the pain that the builders, homeowners, contractors, community members and banks are suffering.  Here is my Twitter stream from the auction –

Here is my Twitter stream from the auction –

Basically, the bank bought all the properties for themselves; they believe there is a market for the properties and they’re right … it’s the price that matters.

Basically, the bank bought all the properties for themselves; they believe there is a market for the properties and they’re right … it’s the price that matters.

Lots of Foreclosures in Today’s HooK

Read ’em all here . I’ll be Downtown tomorrow at 11, as will lots of locals, I suspect.

Foreclosures in Charlottesville and Albemarle

Let’s see some localized context, courtesy a report titled ” Cumulative Foreclosure Actions In Virginia (April 2008)” sent to me by a local lender ( PDF ) – Albemarle County is #68 with .03% Augusta County is #76 with .02% Charlottesville is #78 with .02% Fluvanna County is #98 with .01% Greene County is #65 with .03% Nelson County is 103 with 0% Waynesboro City is #87 with .01% For context, look at Spotsylvania 1.69% and 1.9% Stafford, which equals 727 and 828 housing units respectively under foreclosure. Loudoun County has over 2,000 foreclosures equalling 2.14% of their housing stock.

What’s a mortgage broker to do?

From today’s HooK story on foreclosures in Charlottesville : Prang works out of his house for Carteret Mortgage; he says his mortgage consulting is geared toward the Christian community and home schoolers, which is what his wife does with their three children. … He suggests that people unable to keep up with their payments try something called a “deed in lieu of foreclosure,” in which, with approval, they simply give the house back to the bank.