We’re seeing more short sales and foreclosures in the Charlottesville real estate market, so I figured I’d share this little educational video with you. Thanks to my friend Kris Berg for sharing.

Posts tagged Foreclosures

Mark Your Calenders – Credit and Bankruptcy Lunch and Learn

In a real sign of the time, Piedmont Housing Alliance is offering this seminar – Wednesday, 14 January 200911:30 to 1 pm111 Monticello Ave, Suite 104 Open to the public – Free – (and bring your own lunch) · How long will the bankruptcy stay on my credit? … View Larger Map Limited Seating-Reserve Your Seat CALL 434-817-2436 or email: info@piedmonthousing.org

Charlottesville Foreclosures Study sheds Light on a Surprisingly Hidden Market

From my position as a Buyer-Broker , my advice to my buyers would be – be well qualified and prepared to buy and consider targeting these neighborhoods; they are all very well located with great respective proximities to the University of Virginia Grounds and/or the Downtown Mall – the two major economic hubs of Charlottesville.

…Extent of Crisis, Virginia: The Center for Responsible Lending predicted that 62,174 homes will be foreclosed upon in 2008 and 2009 in the state of Virginia.38 In June 2008, according to the Mortgage Bankers Association, for the foreclosures in the state of Virginia, 54% of them are on subprime and Alt-A loans—“non-traditional†loans while 26% of the foreclosures are on prime and government ARMs and the remaining 20% are on government and prime fixed rate loans.39 In other words, approximately 80% of the foreclosures in Virginia are by higher risk borrowers—subprime lenders and/or ARMs.

Short Sales in Charlottesville – What Realtors (and Consumers) Need to Know

Charlottesville Realtors – take the time to attend the next Short Sale class that’s offered at CAAR – with the expected (some forecast dramatic/staggering/flood – insert your adjective here) increase in short sales next year, you are not going to be adequately prepared for the new market unless you learn about this new segment of our market. … If you see that your income is going to be reduced, but you keep going to Whole Foods or Foods of all Nations, then you’re likely in need of some counseling (and I’m not being facetious).

Foreclosures in Charlottesville Greater than Previously Known/Acknowledged

There’s a fascinating story in today’s Cavalier Daily that brings to light what has previously been discussed here on RealCentralVA – but this time with more data substantiating their claims: “Obviously you see the headlines of [areas] that have drastic numbers of foreclosures,†Lovelady said, noting that it is “easy to think of Charlottesville as isolated from this.†… “The good news is that the number of ARMs and subprime loans originating is decreasing, but many of them are soon to reset ,†Bridger said. ( bolding mine ) As noted in June 2008 – We may not have seen the worst of what this cycle has to offer.

Foreclosures in Charlottesville – Answers to some of the Questions

Foreclosure : This is the auction process by which the lender attempts to do 2 things: obtain clear title to the property by wiping out liens and obligations recorded after the instrument, and occasionally accepting a successful bid that pays all or part of what they are owed. … Often the lender will instruct the trustee to make a bid on it’s behalf that is somewhere very near the amount they are owed, in hopes that someone will either bid higher and they will be made whole, or that once they have clear title, they can then resell and hopefully mitigate their loss.

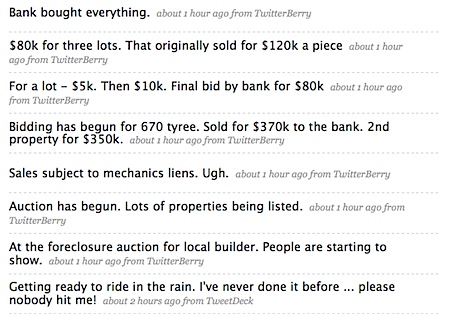

This is What a Foreclosure Auction Looks like in Charlottesville

It was actually quite boring until you think about the pain that the builders, homeowners, contractors, community members and banks are suffering.  Here is my Twitter stream from the auction –

Here is my Twitter stream from the auction –

Basically, the bank bought all the properties for themselves; they believe there is a market for the properties and they’re right … it’s the price that matters.

Basically, the bank bought all the properties for themselves; they believe there is a market for the properties and they’re right … it’s the price that matters.