One of the best parts of this Housing Prospects 50 States Release March 12 2012

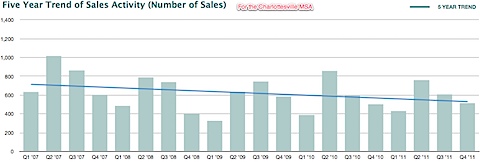

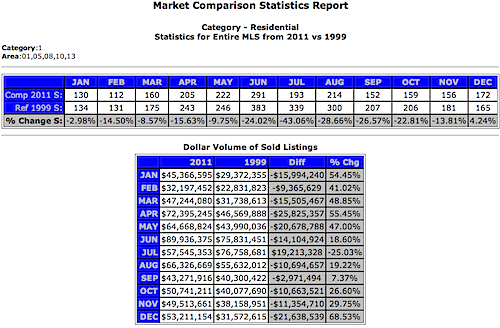

One of the things I said in the Newsplex story is that any market analysis that is broader than a street or neighborhood is too broad to make an informed and educated decision.

Excerpting from the report won’t do it justice; if you’re interested, download the pdf and read it.

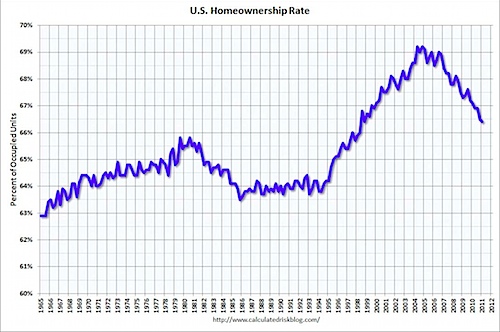

The one quibble I would make is that depending on Zillow for local analysis with respect to the Charlottesville MSA is perhaps not the best idea; but from a macro perspective, they’re worthwhile.

Perhaps the best part of the report is this – William Lucy states the need for local analysis and local perspectives. The housing system may be broken, but the solution is not a one-size-fits-all