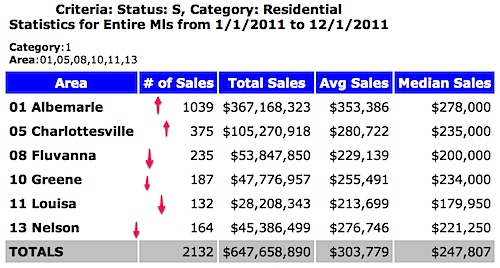

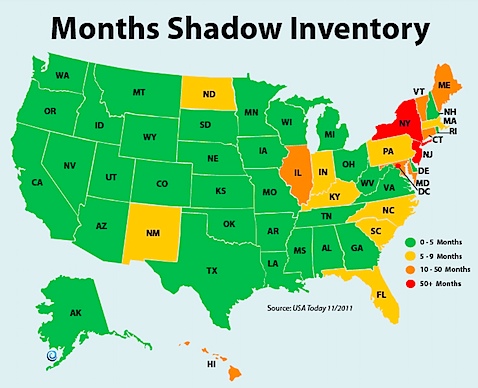

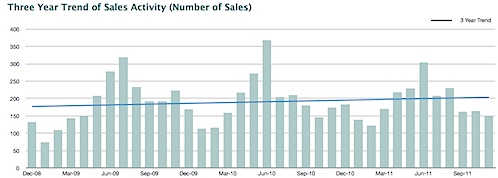

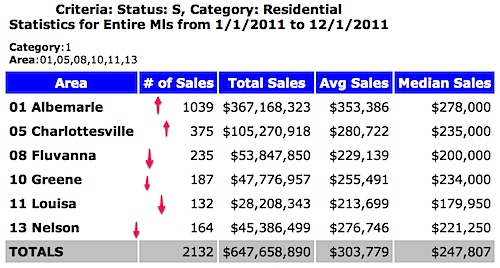

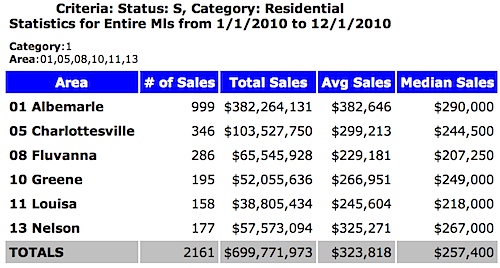

So far* in 2011, more homes have sold this year in Charlottesville and Albemarle than sold last year in the same timeframe. Who knew?

Listen to the podcast of my discussion with Coy Barefoot as we look back at the 2011 Charlottesville real estate market and a look forward to 2012.

[display_podcast]

I’m not saying that the depression is over, but the fact that more homes have sold in Charlottesville and Albemarle, year over year, is a good thing. That the outlying counties’ numbers are down is due to a slew of factors, from foreclosures and short sales to people acting on their desires to be close to stuff. Walkability=Affordability=Profitability=Livability

Attitudes of Young Americans Bode Ill for Housing Recovery (Forbes) – This is something that is going to affect all real estate markets, not just Charlottesville’s, for years (decades?).

The lack of assets isn’t the only encumbrance to housing: Echo Boomers value education, people and leisure more than other American generations. Of the Echo Boomers I spoke with, 13% were homeowners, yet less than a third reported interest in owning a home someday (with female Echo Boomers wanting homes more than male Echo Boomers). They preferred graduate degrees, living in social areas (not suburbs) and freedom instead of homeownership. A few of these Echo Boomers will need a decade to pay off their student loans after which another large loan, like a mortgage, might lack appeal. And while suburbs seem to offer community and safety, they also add transportation costs with a lack of social diversity.

Goodbye, 0-5 Buyer -OR- Finance a House or an Education? (RealCentralVA)

People are staying in their homes longer – whether by choice or necessity. If selling is not a viable option, you need to fall in love with your house all over again.

Residential Remodeling Index at new high in October (Calculated Risk)

Now in Vogue: Practical Remodeling (Wall Street Journal)

UVA Credit Union’s Power Saver Loan–

These new PowerSaver loans will offer qualified homeowners up to $25,000 to make energy-efficient improvements of their choice, such as replacement doors and windows, metal or asphalt roofs, HVAC systems, water heaters, insulation, duct sealing, solar panels, ground source heat pump systems and more.

Interest Rates are still historically low – and they won’t start to matter until they rise.

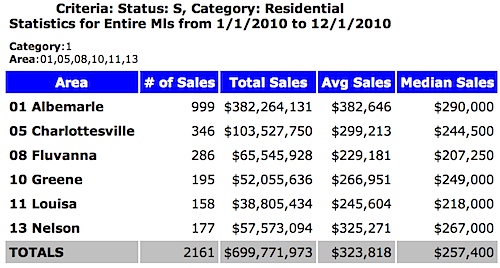

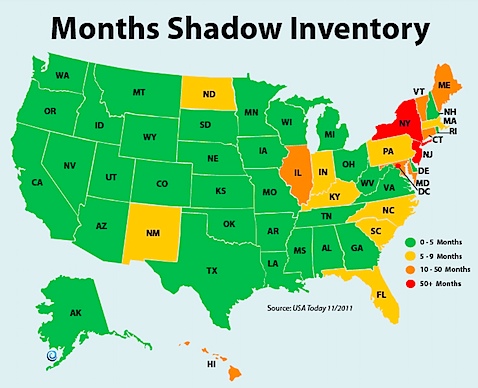

Shadow Inventory – What will it’s affect be on the Charlottesville real estate market?

(thanks to KCM Blog for pointing this out)

Read More