Seen in the Charlottesville MLS this morning for a new listing in a great location close to Barracks Road and Barracks Road shopping center – !!! … APPLIANCES ON PREMISES ARE NOT WARRANTED (May not work) HEATPUMP OR FURNACE IS DISMANTLED.

Posts tagged real-estate

Median Housing Prices for Central Virginia

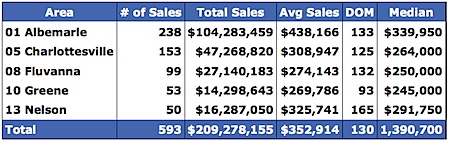

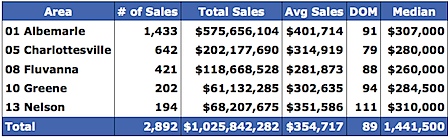

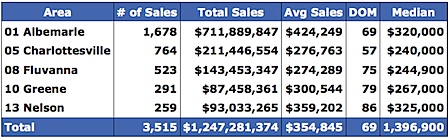

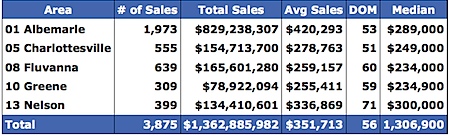

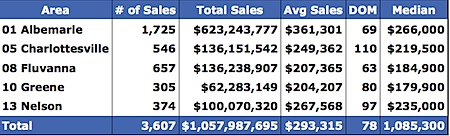

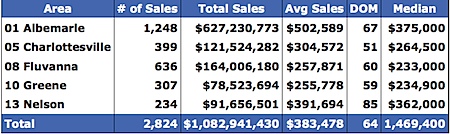

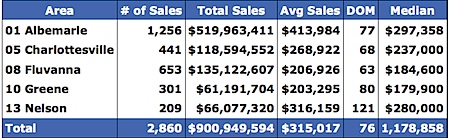

In response to a reader question, these are the median prices for all residential properties in the Central Virginia* region: Quick summary – 2006 was the peak year. 2008  2007

2007  2006

2006  2005

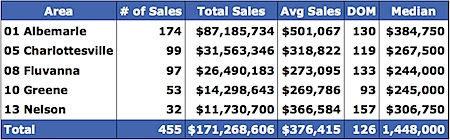

2005  2004

2004  After the break, I show the median prices for just single family homes in the region – excluding condos and attached homes. … Data for the Shenandoah Valley – Waynesboro and Augusta Counties, is just not as robust as what we have in the Charlottesville MLS – so I am unable to post their data with confidence. 2008

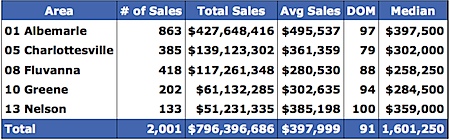

After the break, I show the median prices for just single family homes in the region – excluding condos and attached homes. … Data for the Shenandoah Valley – Waynesboro and Augusta Counties, is just not as robust as what we have in the Charlottesville MLS – so I am unable to post their data with confidence. 2008  2007

2007  2006

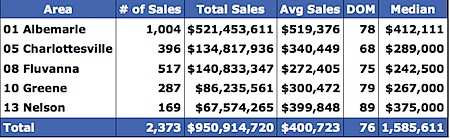

2006  2005

2005  2004

2004

This is a test – it is only a test (of print advertising)

I have long advocated against print advertising – in 2006 , 2007 , and this year (there are more stories here, but this is but a sampling) and my argument has been consistent – there is no method by which to track print advertising’s ROI. … Maybe I’m wrong about this experiment, but there is only one way to learn – and failing is a great way to learn.  * The incorrect data displayed in this week’s issue aside, I think this could be a good venue.

* The incorrect data displayed in this week’s issue aside, I think this could be a good venue.

What will MLS data standards do for the consumers?

With the recent talk of how forthcoming data standards are going to make property data sharing more efficient and thus better for consumers and Realtors, here is one of my requests – I’d love to see a (Google) Mashup (or the MLS would be even better, and I think a no-brainer) providing an overlay of school districts. … Even better, make it so that registered users could make their own pages with all their important locations to help them organize their thoughts and help their Realtor representatives better understand their thoughts and thought processes.

Where’s Charlottesville in the Case-Shiller index?

And today, Tuesday, there’s this : ‘Yale economist Robert Shiller, who developed one of the widely followed gauges of home prices, said in a speech Tuesday that home prices, which have already fallen about 15 percent from their peak in 2006, may fall further than the 30 percent drop experienced during the Great Depression of the 1930s, so far the biggest decline in home prices in the country. “Basically we are in uncharted territory,†Shiller said, noting that the 85 percent rise in home prices from 1997 to 2006 after adjusting for inflation had represented the biggest housing boom in U.S. history, so the fall in prices could be just as historic.’

“Without forecasts, we don’t look credible”

Even if they’re wrong.